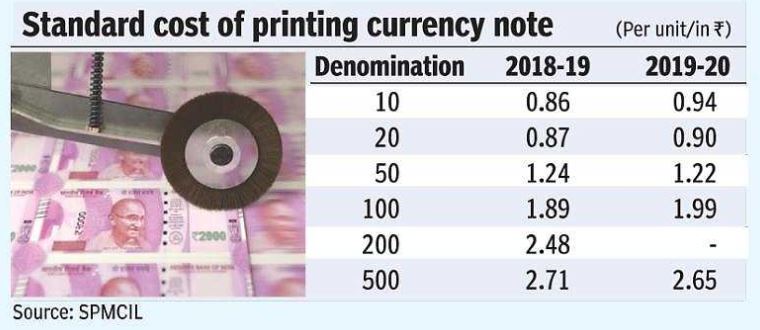

The cost of printing currency notes in the denomination of ₹50 and ₹500 is cheaper when compare to printing cost of ₹10, ₹20 and ₹100 notes.

Security Printing and Minting Corporation of India Limited and Bharatiya Reserve Bank Note Mudran Private Limited prints Indian currency notes as per the indent by Government and RBI. According to the information given by the Currency Note Press to an RTI (Right to Information) filed by this correspondent, the standard cost of printing one currency note in the denomination of ₹50 was ₹1.24 in 2018-19, which came down to ₹1.22 in 2019-20.

Similarly, the cost of printing one ₹50 note dropped to ₹2.65 from ₹2.71. The cost of printing of each unit of ₹200 in 2018-19 was ₹2.48. However, no cost price was given for FY20. No indent was placed for printing ₹2,000 note in FY20.

Though Security Printing Corp did not give any reason for the change in the printing costs, officials attribute it variously to lower input costs or reduced supply due to lower requirements.

According to the RBI’s Annual Report for FY20, indent placed for ₹500 notes was 1,463 crore pieces, while the actual supply from Security Printing Corp was 1,200 crore pieces.

Similarly, the indent for ₹50 notes was 240 crore pieces, while the actual supply was 234 crore pieces. The supply of ₹100 notes also was less than the indent but not by much.

The Annual Report says: “The indent of bank notes for 2019-20 was lower by 13.1 per cent than that of a year ago. The supply of bank notes during 2019-20 was also lower by 23.3 per cent than in the previous year, mainly due to the disruptions caused by the outbreak of Covid-19 and the ensuing lockdown.”

The volume and value of bank notes to be printed in a year depends on various factors such as the expected increase in ‘Notes in Circulation’ (NIC) to meet the growing public demand, and for replacing soiled/mutilated notes so as to ensure that only good quality notes are in circulation.

The expected increase in NIC is estimated using statistical models, which consider macro-economic factors such as expected growth in GDP, inflation, interest rates and growth in non-cash modes of payment. The replacement requirement depends on the volume of notes already in circulation and the average life of banknotes. Besides these factors, the RBI estimates the volume and value of notes to be printed in a year also on the feedback received from its regional offices and banks on the expected demand for cash. It, then, arrives at the final number in consultation with the Government and the four printing presses – two under Security Printing Corp and two under Bharatiya Reserve Bank Note Mudran Private Limited.

Input: The Hindu Business Line