Recently, The Income Tax Department has launched the new e-filing website for Income Tax Returns on 7th June 2021. The new income tax e-filing portal can be accessed at https://www.incometax.gov.in. It comes with new features which are expected to make the ITR process much smoother and faster. Likewise, the IT department is also made easy to link your Aadhar with PAN in new e-Filing website.

How to link your Aadhar with PAN?

You all might have received a message to your mobile number from the IT department in which you are advised to link your Aadhar with PAN in e-filling website for easy filing of your IT return. In view of the same, here we have given the step by step process to link Aadhar with PAN.

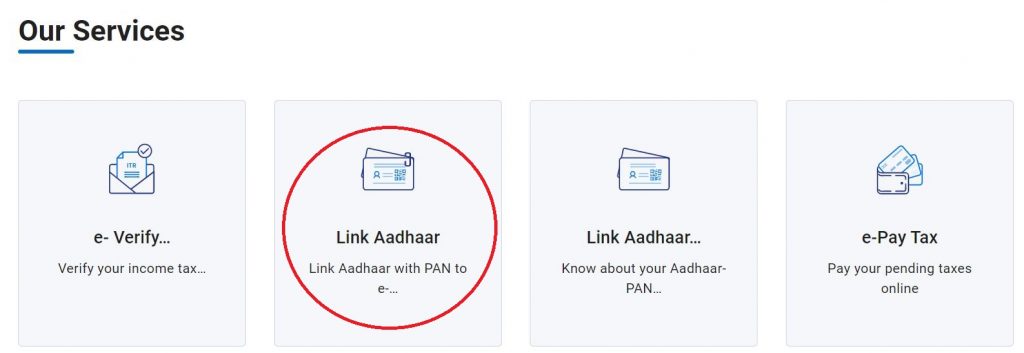

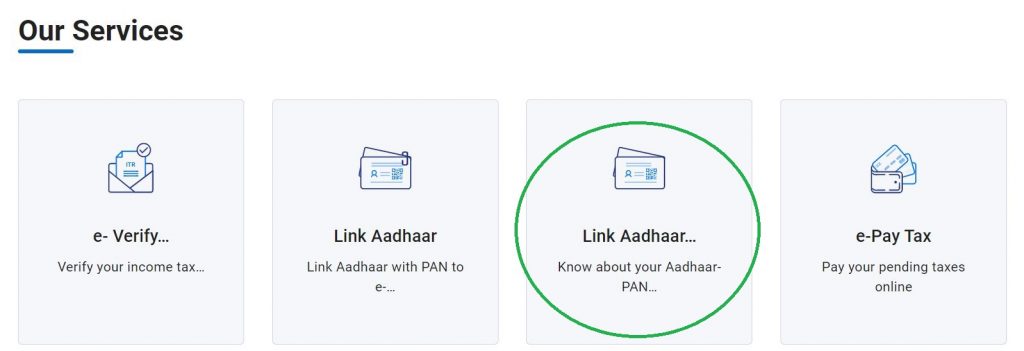

Firstly, visit e-filing official website https://www.incometax.gov.in and then Click on the “Link Aadhar” menu in the Our Services section.

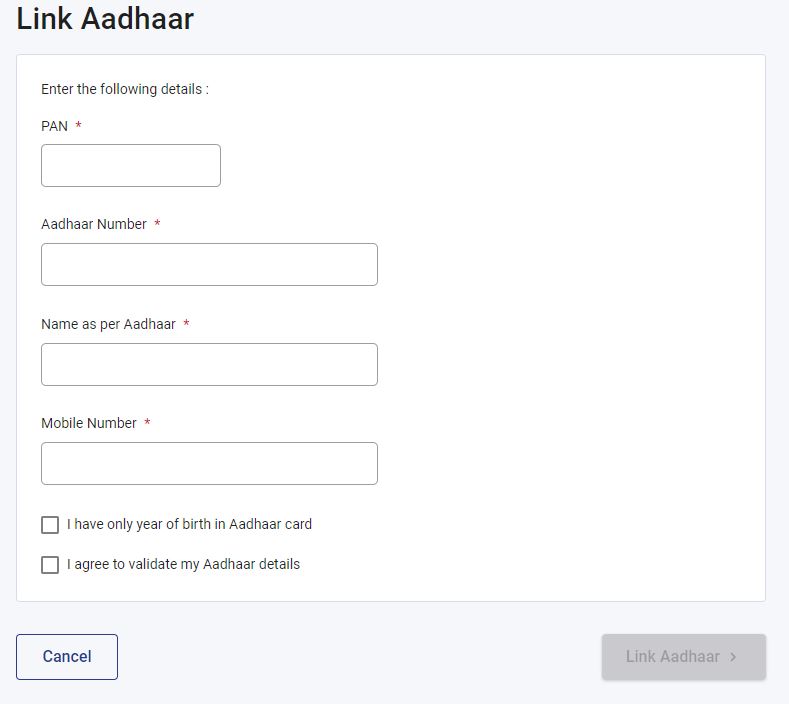

Then you will be moved to the next screen. Here you have to enter your PAN, Aadhar Number, Name as per Aadhar, Mobile Number and tick the check box and then click “Link Aadhar” button as shown in the below image.

Note:

1. Name, Date of Birth and Gender as per PAN will be validated against your Aadhaar Details

2. Ensure that ‘Aadhaar Number’ and ‘Name as per Aadhaar’ is exactly the same as printed on your Aadhaar card

Then you will receive an OTP to your mobile number. Enter the OTP in the respective fields and then click on “Validate” button. Now you have successfully completed Aadhar linking.

Note:

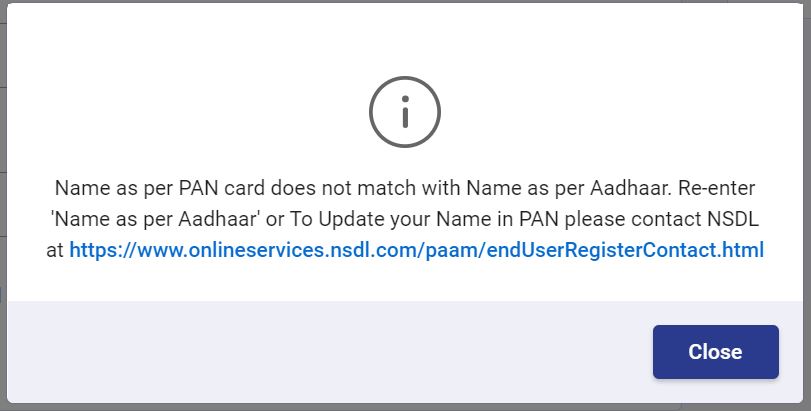

If your name in Aadhar is not matched with your PAN, you have to change your name either in Aadhar or in PAN for successful completion.

How to check the status of linking Aadhar with PAN?

After linking your Aadhar with PAN, you can also check the status by the following steps

Firstly, visit e-filing official website https://www.incometax.gov.in and then Click on the “Link Aadhar Status” menu in the Our Services section as shown in the below image.

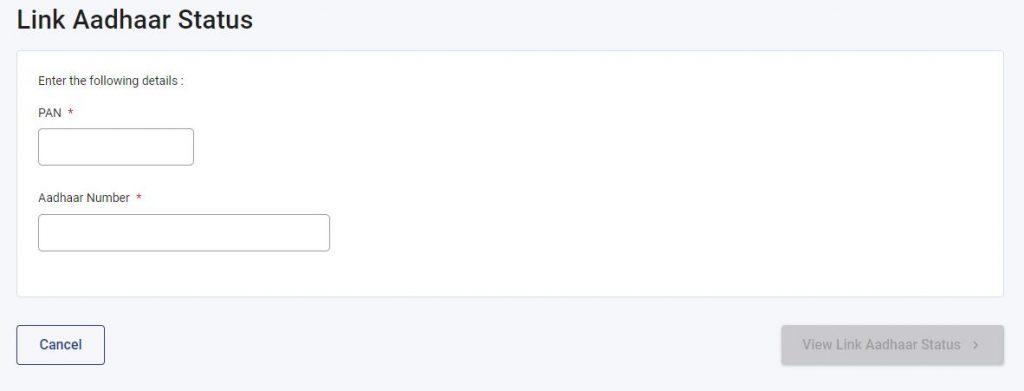

Then you will be moved to the next screen. Here, you have to enter your PAN and Aadhar Number and then click on “View Link Aadhar Status” button as shown in the below image.

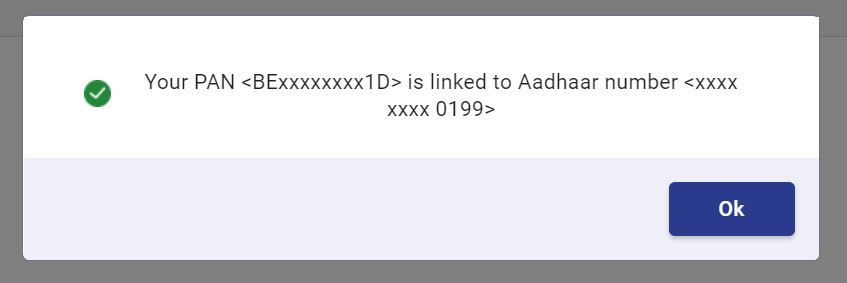

And then you can see the confirmation as shown below if your Aadhar and PAN were already linked in Income Tax portal.

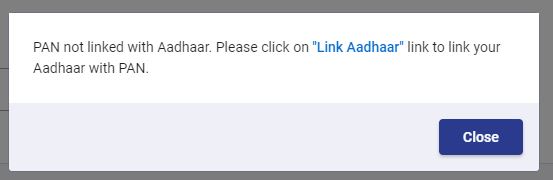

If you are not registered your Aadhar with Pan previously, then you will get the message as per the below image

Note:

Last Date for linking your PAN with Aadhar is 31st March 2022.

Frequently Asked Questions

What is the URL of new e-Filing website?

The new e-Filing 2.0 website can be accessed at https://www.incometax.gov.in

Which is the Late date for linking PAN with Aadhar?

The Income Tax Department has given deadline for linking PAN with Aadhar March 31st, 2022.

Who are required to link their PAN with Aadhar?

All individuals have to mandatorily link their PAN with Aadhar.

What will happen if you fail to link within deadline?

Central Board of Direct Taxes (CBDT) has informed that if anyone fails to link PAN card to Aadhaar card, it will become inoperative.

What will happen if PAN card become inoperative?

If your PAN card becomes inoperative, then you will not be able to conduct financial transactions wherever quoting it is mandatory.

Whether any penalty will be levied after due date?

If you are trying to link the PAN with Aadhar on or after the due date, then you will be liable to pay a penalty of Rs 1,000.

[…] How to link Aadhar with PAN in new e-Filing website 2.0? […]

[…] of new income tax e-filing portal is https://www.incometax.gov.in. Many new features such as Aadhar Pan linking, e-verify, e-pay tax, verify TAN, Pan Aadhar linking status, ect,. are available in new website. […]

[…] URL of new income tax e-filing portal is https://www.incometax.gov.in. Many new features such as Aadhar Pan linking, e-verify, e-pay tax, verify TAN, Pan Aadhar linking status, ect,. are available in the new […]

[…] e-filing 2.0-How to link Aadhar with PAN in new website … […]

[…] new income tax e-filing portal is https://www.incometax.gov.in. Many new features such as Aadhar Pan linking, e-verify, e-pay tax, verify TAN, Pan Aadhar linking status, TDS on cash withdrawal, ect,. are […]