If you are doing a business, you need to know your cash withdrawal limit without TDS. As per the Government norms, you have to pay TDS (Tax Deduction at Source) for cash withdrawal beyond the permissible limit. You may be an Individual or an Entity, you can withdraw cash only up to Rs. 20 Lakhs as permissible limit without affecting TDS for a Financial Year, i.e, From April 01 to March 31.

Note:

Cash withdraw limit includes both ATM and branch withdrawal

If you withdraw cash beyond this permissible limit (Rs. 20/- Lakhs) from your bank, they will detect 2% TDS for excess withdrawal. Your bank will deposit this TDS amount to Government in your PAN number and will give TDS certificate for the same. You may claim the TDS amount at the time of filing your Income Tax.

Further, you can also increase your cash withdraw limit to Rs. 1 crore by submitting your Income Tax filing acknowledgement copies for three years to your bank. Then your bank will allow you to withdraw cash up to Rs. 1 crore for the particular financial year.

Table of Contents

How to know your cash withdrawal limit without TDS?

As we all know, The Income Tax Department launched the new e-filing website for Income Tax Returns. The URL of new income tax e-filing portal is https://www.incometax.gov.in. Many new features such as Aadhar Pan linking, e-verify, e-pay tax, verify TAN, Pan Aadhar linking status, ect,. are available in the new website. Accordingly, you can also check your cash withdrawal limit and TDS Rate(%) in new e-filing 2.0 portal.

Step: 1

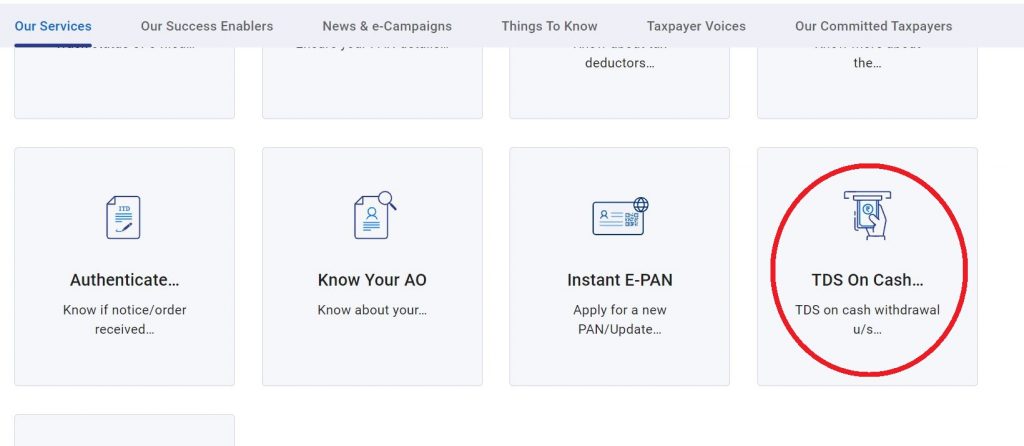

Firstly, visit e-filing official website https://www.incometax.gov.in and then Click on the “TDS on Cash Withdrawal” menu in the Our Services section.

Step: 2

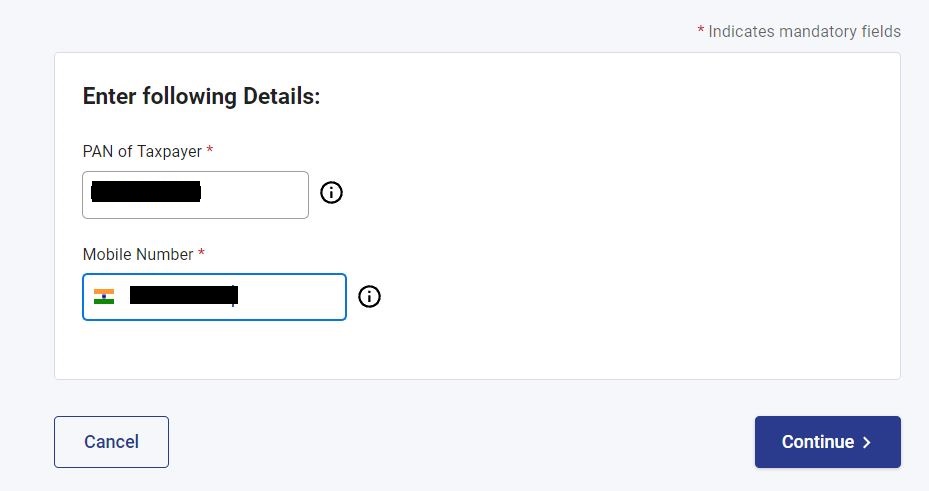

In the next step, Enter your PAN number and Mobile number in the respective fields and then click on “Continue” button

Step: 3

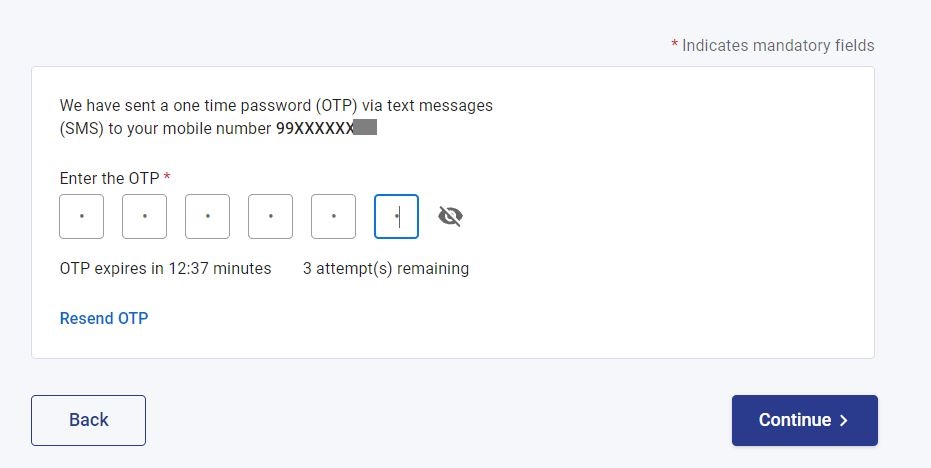

- Then, you will receive a 6-digit OTP to your registered mobile number.

- Enter OTP in the respective field and click on “Continue” button

Step: 4

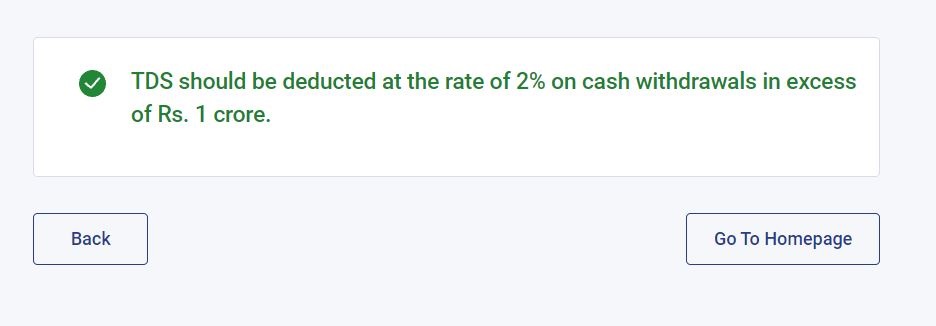

Then, it will display your cash withdrawal limit (either Rs. 20 Lakhs or Rs. 1 Crore) as well as your TDS rate for excess withdrawal

You can also claim your TDS at the time of your Income Tax filing.

[…] such as Aadhar Pan linking, e-verify, e-pay tax, verify TAN, Pan Aadhar linking status, TDS on cash withdrawal, ect,. are available in the new website. Apart from that, you can also check your Income Tax Return […]