Every human being in the world is familiar with the word ‘LOAN’. Because, the term ‘Loans’ satisfies their needs and also fulfill their dreams. Whether it is a small dream or life time goal, loan definitely plays a vital role for achieving the desired things.

What is a Loan?

A ‘Loan’ is a debt incurred by an Individual or an Entity for the purpose of obtaining something they wanted. In other words, the person or entity who gets a loan is called as “Borrower” and the person or entity who gives a loan is called as “Lender” (Banks). In other words, Lender lends a sum of money to the borrower for fulfilling their needs. Further, there is a written or oral contract between the Lender and the Borrower that the borrowed money (Principal) along with interest should be returned to the lender in fully or in installment within the specified period. Generally, the term Principal refers to money borrowed and Interest refers to additional money which is agreed to pay to the lender.

What are the types of loans?

There are two types of loans:

Secured Loans and Unsecured Loans

What is a Secured Loan?

The Banks and other lending institutions lend money by accepting any movable or immovable property as security is called Secured Loan. This is in order to ensure that the loans and advances of the banks are properly repaid by the borrower. More particularly, the secured item is acquired out of bank financed money. For example, Car loan is secured one in which the Car is acquired out of financed amount. Further, Secured loans are usually larger in quantum and lower in interest rate.

Examples of Secured loans are

- Home Loans

- Car Loans

- Two Wheeler Loans

- Business Loans

- Mortgage Loans. etc,

Advantages of Secured loan;

For Banks & Lending Institutions

- Firstly, Ensured Repayment

- Secondly, Larger Advances

- Lastly, Larger Interest Income

For Borrowers

- Lower Interest Rate

- Lager Advances

- Larger Repayments Periods

What is a Unsecured Loan?

Unlike secured loans, Unsecured loan does not carry any collateral security for loan’s coverage. Also, It is usually smaller in quantum and larger in interest rate.

Examples of Unsecured Loans are

- Personal loans

- Educational loans

- Credit Cards

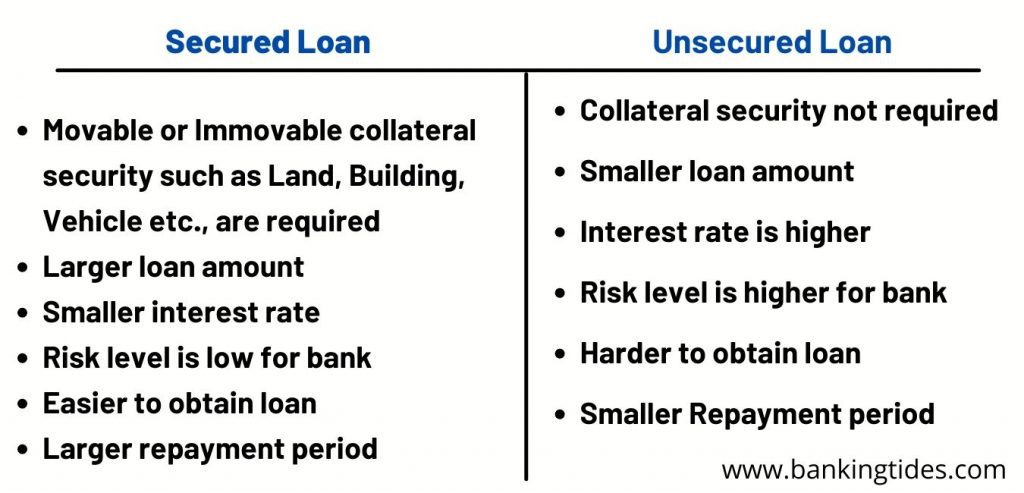

Difference between Secured and Unsecured loans:

- Movable and immovable security such as land, building, vehicles are available in secured loans. Contrary to this, collateral security is not available in unsecured loans.

- Generally, secured loans are larger in quantum of amount as well as larger in repayment period. Contrary to this, unsecured loans is smaller in quantum of loans amount and also smaller in repayment period.

- Similarly, secured loans attracts smaller in rate of interest where as unsecured loans is larger in rate of interest.

- Risk level in Secured loan is very low as there is a security available. Conversely, unsecured loans are high level risk for banks and other lending institutions since security is not available.

- Above all, secured loans are easier to obtain by the borrower since most of the banks are willing to lend secured loans. On the other hand, unsecured loans are harder to obtain.