Interest is the cost of using somebody else’s money. When you borrow money, you pay interest. When you lend money, you earn interest. Use interest calculator to know your earnings.

Interest is otherwise called ‘additional cost’ incurred for using somebody else’s money. When you borrow money, you pay interest, at the same time when you lend money, you earn interest. It is usually calculated as percentage of a loan or a deposit paid to the lender periodically. The interest rate is usually quoted in annual rate for calculation.

There are two types of interest calculation available for lender: a) Simple Interest and b) Compound Interest.

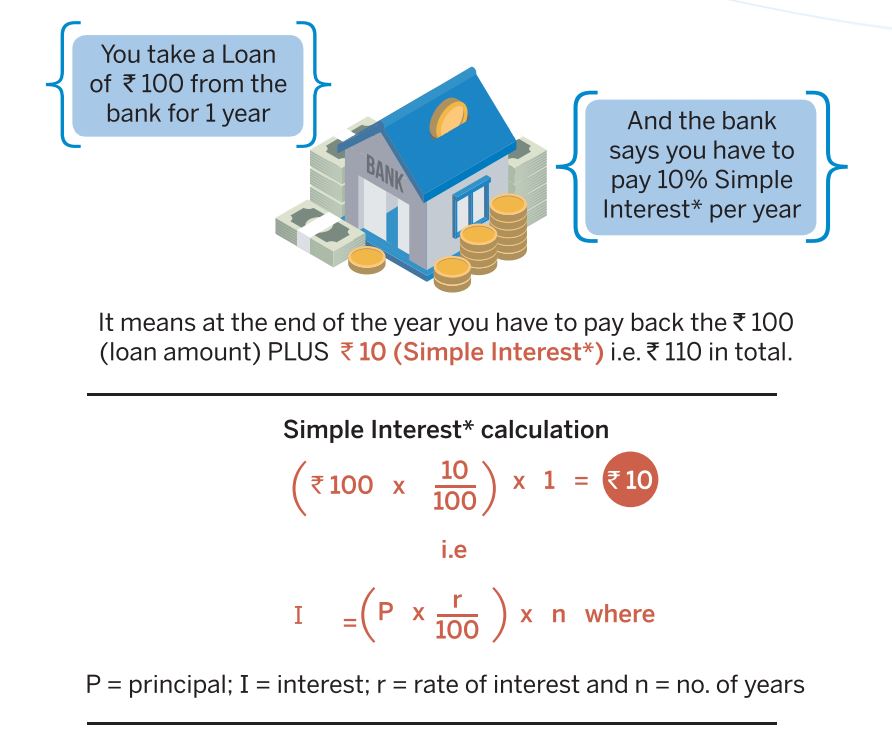

What is Simple Interest?

Simple interest is the simplest form of interest calculation which calculates interest only on Principal amount you borrow or lend. It does not calculate interest on interest (which usually compounding interest does).

How does Simple Interest calculate?

Simple interest formula:

I = P * N * R/100

P = Principal; I = Interest; N = Number of years; R = Rate of Interest

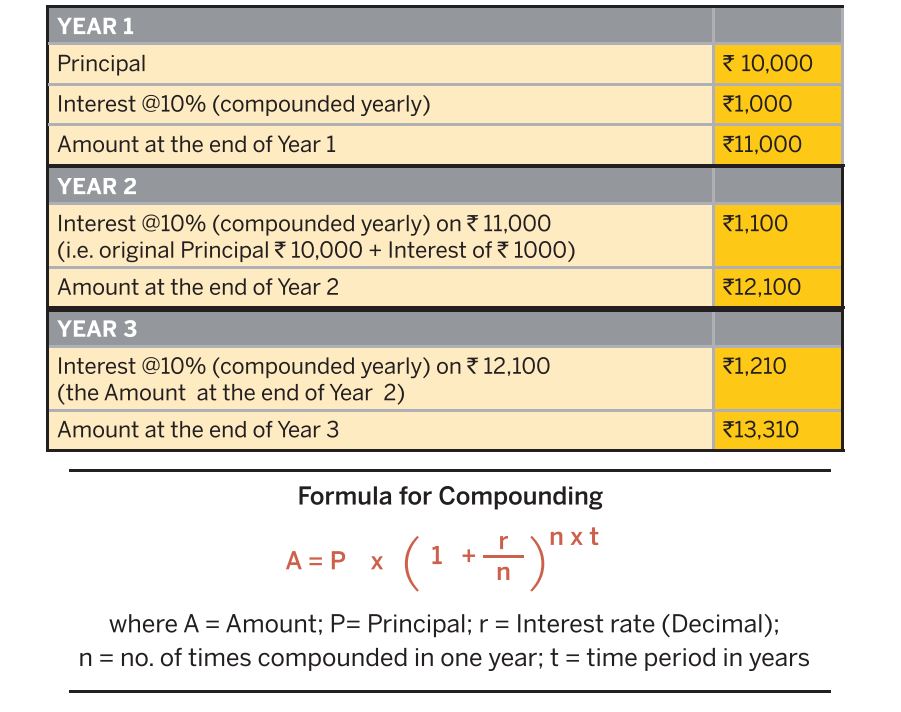

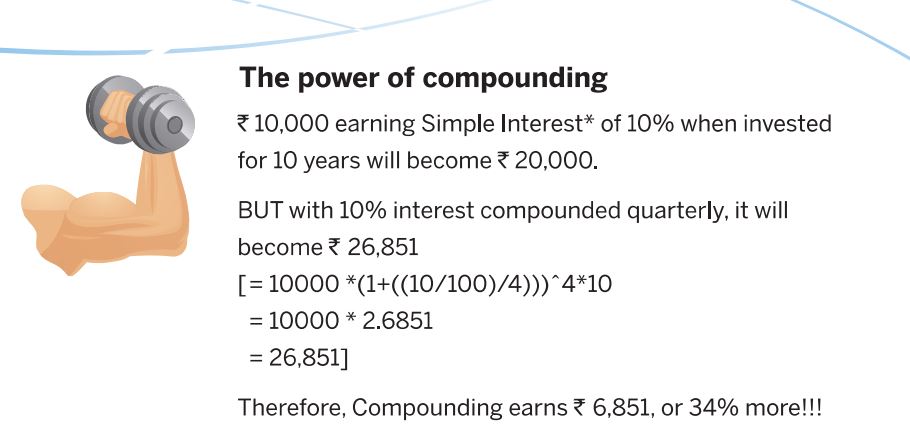

What is Compound Interest?

Compound Interest calculates interest on principal and interest also. Compounding in also called ‘Interest on Interest’. In compounding, the benefit for the investor is that interest earned is added to the principal and re-invested. Therefore, it earns interest on the principal plus interest.

How does Compound Interest calculate?

When this compounding takes place over longer duration, the return become much higher compare to Simple Interest

How do I earn interest?

If you have surplus money more than your daily spending, you can either invest it in interest bearing Savings account, Fixed Deposit, or you can lend it to someone for the interest income.

If you prefer Banks investments, they do the lending it for you. That is, they use your money to offer loans to other customers and make other investments, and they pass a portion of that revenue to you in the form of interest. Banks pay interest periodically, say Monthly, Quarterly, Half yearly and Yearly. You can check your savings account transaction for the interest payment. Your savings can really build a momentum when you leave the interest in your account; you’ll earn interest on your original deposit as well as the interest added to your account.

If you prefer lending your money for interest income, you must be very careful in selecting right borrower. Here, you can earn more interest than bank deposit at the same time RISK is also very high. Sometimes, the borrower may fail to repay interest, in that case getting back our principal money is also questionable. So, bank investment is the safest form of interest income than self-lending method.

When do I have to pay interest?

You must pay interest when you borrow money from someone. That is, you have to pay additionally agreed amount for the money borrowed for the privilege of using it. You must be very careful while borrowing money from someone. Your have to consider your repaying capacity, rate of interest, purpose of borrowing, repayment method while borrowing.

Key points to take

Interest is an additional cost you agreed to pay for your loan or to get for your deposits.

Simple interest calculates interests only on principal whereas Compound interest calculates interests on both principal and interest earned previously.

If you invest in bank deposits, risk is low and interest income is less. If you do own lending, risk is high and interest income is also high. Borrow money only when needed and borrow from formal institution.

Click Here to use our standard RD Interest Calculator to calculate Recuring deposit interest.

Click Here to use our standard Fixed Deposit Interest Calculator to calculate Fixed deposit interest.

Source: www.rbi.org.in

[…] or oral contract between the Lender and the Borrower that the borrowed money (Principal) along with interest should be returned to the lender in fully or in installment within the specified period. Generally, […]

[…] of Interest of RD is fixed for the whole investing period. ROI will not be changed in the middle of RD. […]