In our previous article we explained about how to register for Axis Bank mobile application?. Generally, we use mobile banking application primarily for funds transfer purpose. Here, in this post we are explaining about how to do NEFT fund transfer in Axis Bank mobile application?.

How to transfer funds in Axis Bank mobile application through NEFT?

Follow the below simple steps to do NEFT fund transfer in Axis bank mobile application.

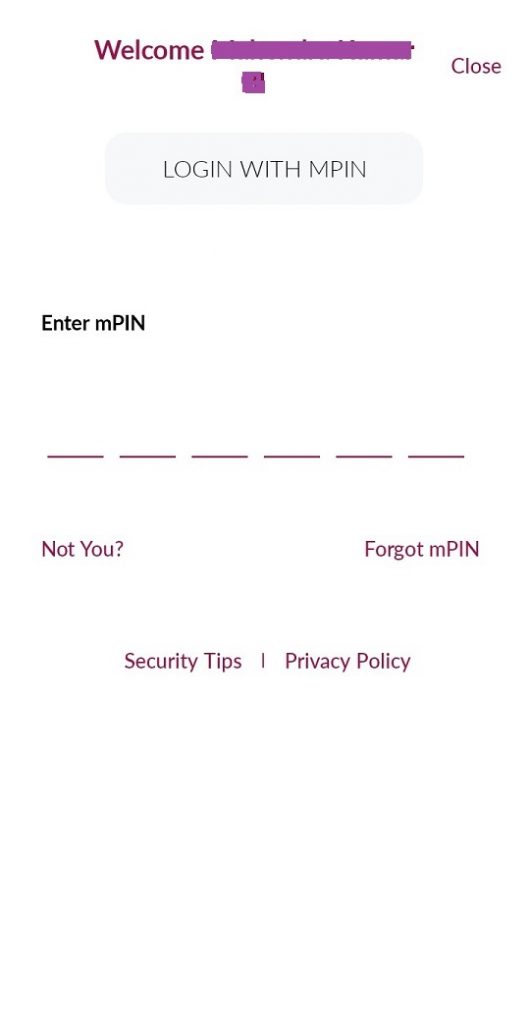

- Firstly, open Axis Mobile application in your mobile phone. It will ask for your mPin to log in. Enter your mPin in the respective field then you will get in to your home page.

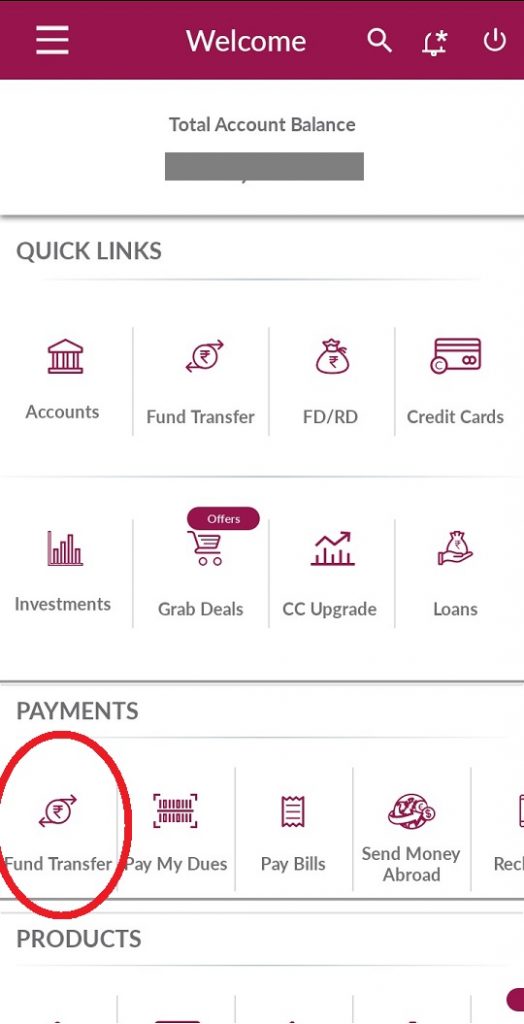

- In front page, click on the Fund Transfer option in the Payment section as shown in the below image.

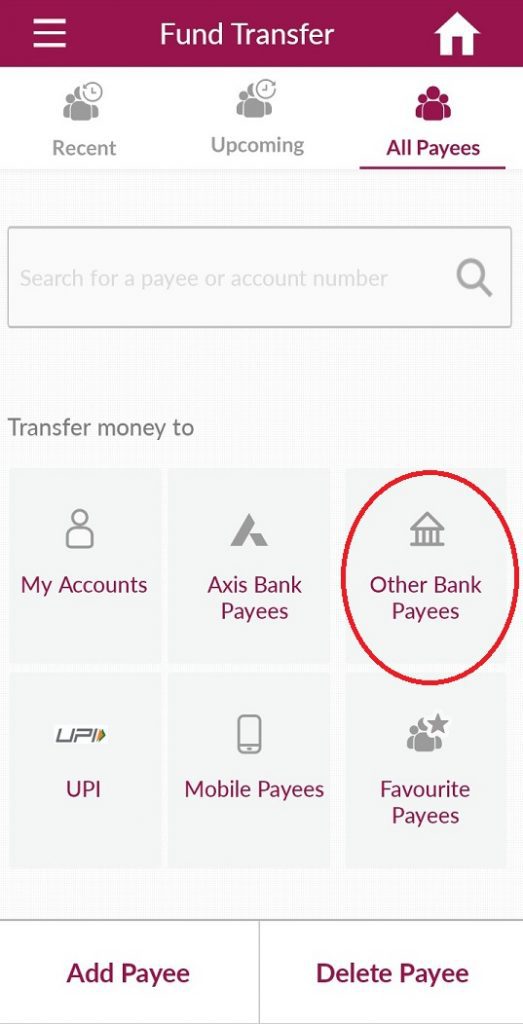

- In the next screen, you will see the list of funds transfer options available in the mobile application.

- Then click on the Other Bank Payees option as shown in the below image to transfer funds to other bank accounts.

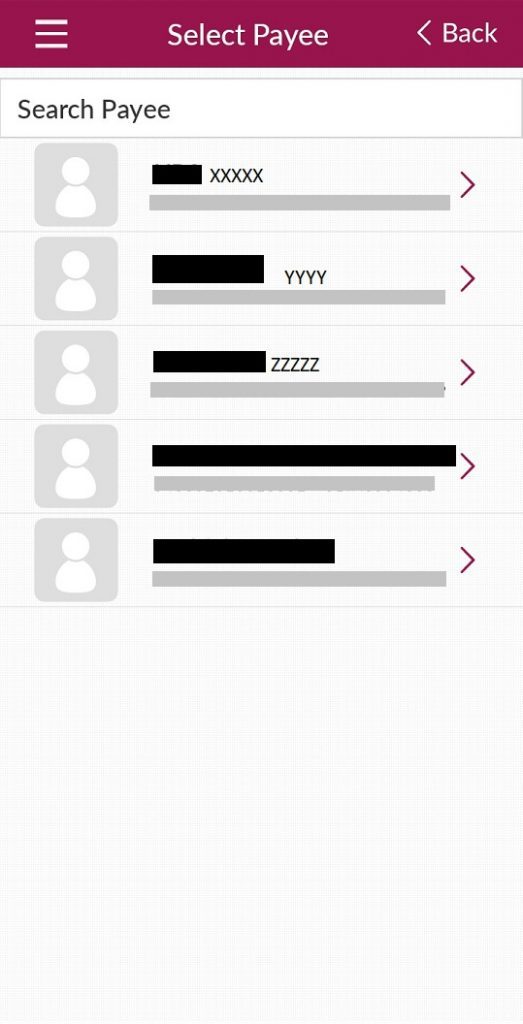

- In the next screen, you will see the list of payee accounts which are already saved in your mobile application.

If you want to transfer the funds to new account, then you have to add that account using Add Payee option.

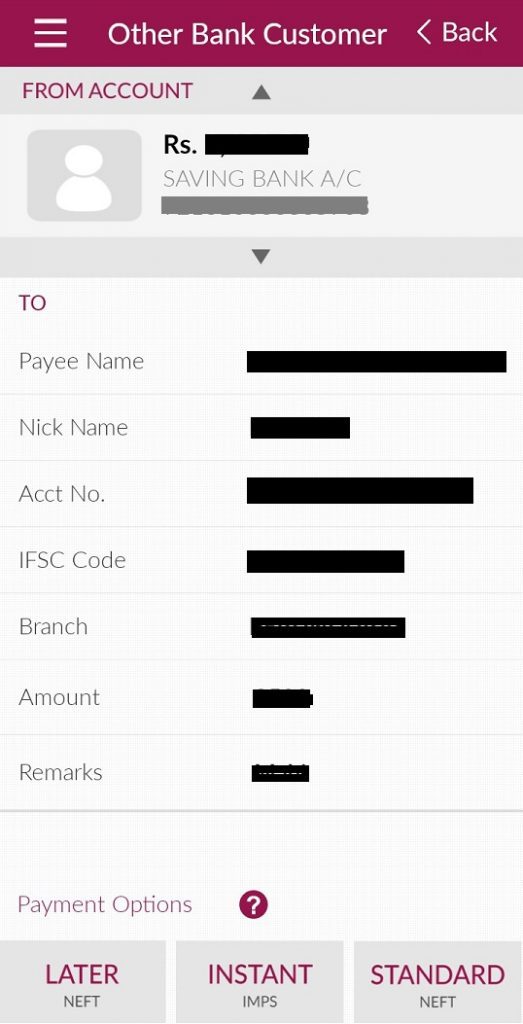

- Now click on the payee account then you will see the beneficiary account name, account number, ifsc code in the next screen

- Then, enter the transfer amount in Amount field, remarks in Remarks filed and then click on Standard NEFT option for transferring the funds through NEFT mode.

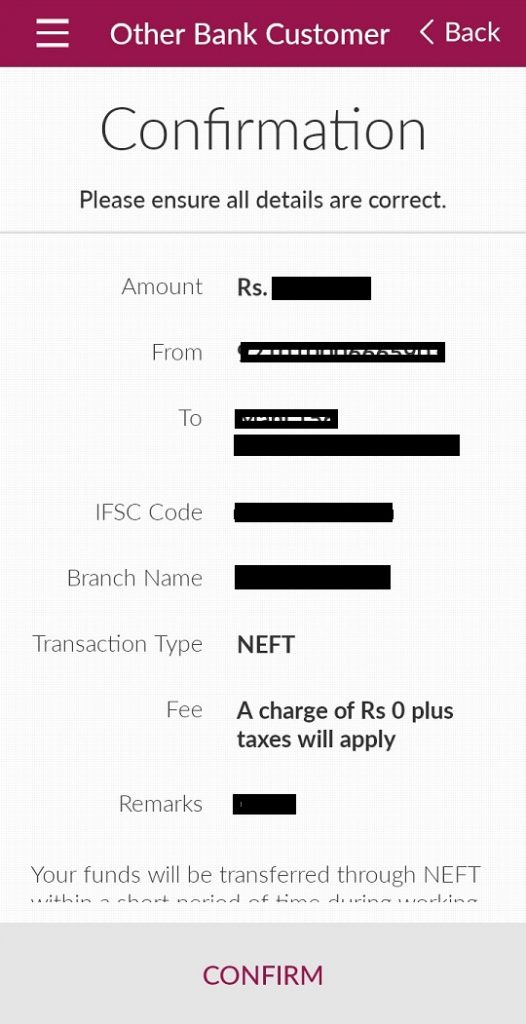

- In the next step, it will display all details for your verification. Ensure the details are correct and then click on ‘CONFIRM’ button.

- In the step, it will ask for your mPin for validation. enter your mPin in the respective field correctly.

- On successful validation, you will see the message ‘Your transfer has been initiated successfully’ as shown in the below image.

- Now the respective transfer amount will be debited from your account immediately and then reach your beneficiary account within 1 hour as per the NEFT batch timing.

Unlike earlier, Now you can use NEFT funds transfer method in round the clock basis. That is, NEFT works on 24/7 basis.

In the same way, you can also do fund transfer using IMPS method. Unlike NEFT, IMPS transfer the funds to the beneficiary instantly.