ITR Filing – It is every one’s responsibility to file the income tax return online every year. The taxpayer whose annual gross income, whether salaried income or business income, is beyond the prescribed limit, it is his/her responsibility to file the income tax return online within the time bound given by the government for the particular year.

Presently, in our India, the basic exemption limit

| S. No | Tax payer | Gross Annual Income |

| 1 | General – Individual below 60 years | Rs. 2.50 Lakhs |

| 2 | Senior Citizen – Individual above 60 years but below 80 years | Rs. 3.00 Lakhs |

| 3 | Super Senior Citizen – Individual above 80 years | Rs. 5.00 Lakhs |

Why ITR is important for a country?

ITR filing of a taxpayer is essential for a country since tax income is the backbone of wealth of a country. Though various taxes are available in a country, “income tax” of a citizen plays a major contribution for revenue generation of a country.

Central Board of Direct Taxes (CBDT), a statutory authority functioning under the Central Board of Revenue Act, 1963, has come up with 7 forms till date ie., ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 & ITR 7. Further, The applicability of this ITR forms varies depending on the sources of income of the taxpayer, the amount of the income earned and the category the taxpayer like individuals, HUF, company, firms, TRUST, etc.

Which ITR to file?

| S. No | ITR | Category and Income |

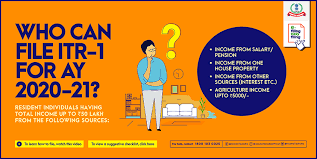

| 1 | ITR 1 | Resident Individual having total income up to Rs. 50 Lakhs from the following sources Income from Salary / Pension Income from One House Property Income from Other Sources (Interest etc.,) Agricultural income up to Rs.5000. |

| 2 | ITR 2 | Individuals and HUFs not carrying out business or profession under any proprietorship |

| 3 | ITR 3 | Individuals and HUFs having income from a proprietary business or profession |

| 4 | ITR 4 | Presumptive income from Business & Profession |

| 5 | ITR 5 | Persons other than,- (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7 |

| 6 | ITR 6 | Companies other than companies claiming exemption under section 11 |

| 7 | ITR 7 | Persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) or 139(4E) or 139(4F) |

Steps to e-File your Income Tax Returns online

Step 1

- Firstly, Visit www.incometaxindiaefiling.gov.in and click on registered user

- Enter your PAN number, Password, Captcha code and click Login

Step 2

- Secondly, Click on the e-File menu and click Income Tax Return

- Choose Assessment year

- Select ITR Form Number

- Choose Filing Type

- Select Submission Mode as ‘prepare and submit online’

Step 3

- Click on Continue and Fill all the mandatory fields on the online ITR form

Step 4

- Choose the verification option in the ‘Taxes Paid and Verification’ tab

Step 5

- Then, Click on the ‘Preview and Submit’ and verify all the data entered in the form

- Submit the ITR form

Step 6

- E-Verify through Aadhar OTP

Due to Covid19, the due date for filing ITR for the FY 2019-20 (AY 2020-21) has been extended up to 31st December 2020 and for Tax audit and TP cases, the due date extended up 31st January 2021.