In our previous articles we have explained about How to activate KVB Dlite Mobile Banking? and How to reset Login Pin and Mpin for KVB Dlite application?. Now this article will explain you how to add beneficiary account in KVB Dlite mobile application.

Why beneficiary addition is needed in Mobile Banking?

As we all know, the main purpose of using Mobile banking facility is Fund Transfer. We all want to transfer funds as quickly as possible for our business and personal purpose. Many people often do fund transfer to same account depends upon their needs. It takes too much time while entering the same account number, same name and same IFSC code to transfer funds. If you add that particular account as BENEFICIARY account in your Dlite application, you can fetch these account details any time for fund transfer. It not only saves your time but also transfer the funds quickly and error free.

How to add beneficiary in Dlite Mobile app?

The beneficiary account can either be a KVB Account or Other Bank Account. Further, you can add different type of account such as Savings Account, Current Account and Cash Credit Account as beneficiary in Dlite application to transfer the funds easily. The following are simple steps to add beneficiary in KVB Dlite mobile application.

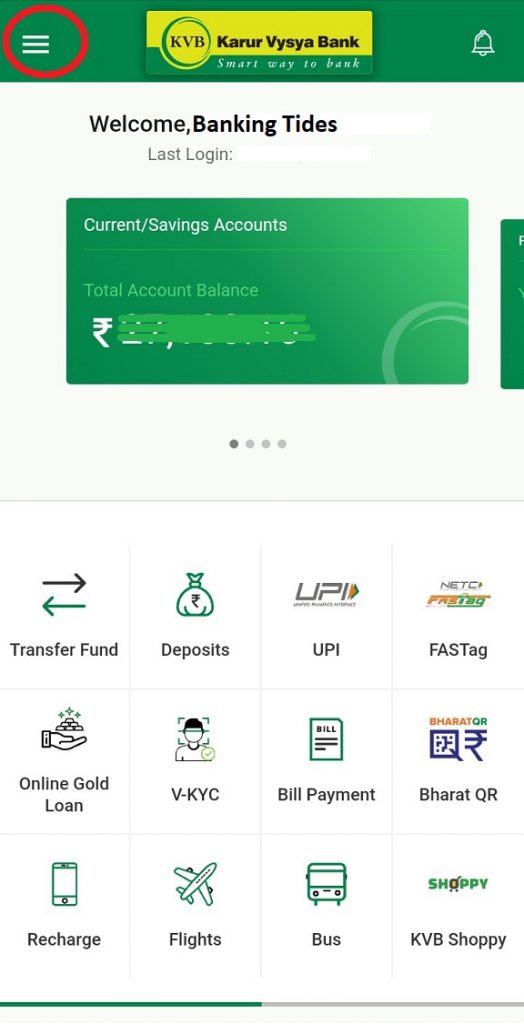

- Firstly, login to your Dlite mobile application using 6-digit login pin. On the home page, click on Menu option in the top left corner as shown in the image.

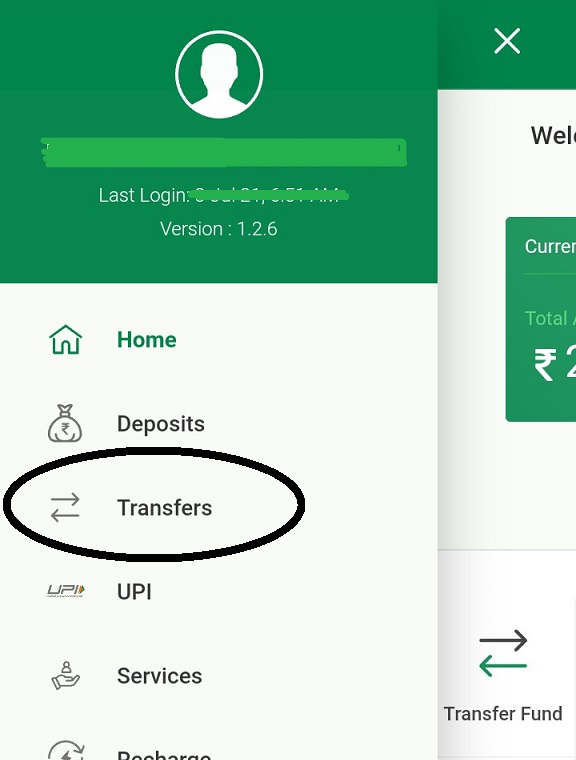

- Then you will see the list of options available in the application. Now, select ‘Transfer‘ option then you will be moved to the next screen.

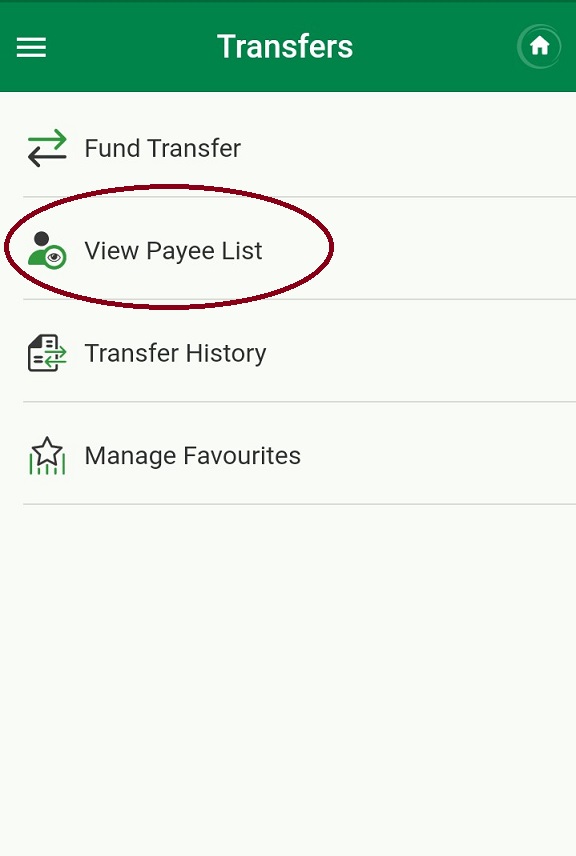

- Now, select ‘View Payee List‘ option as shown the image below.

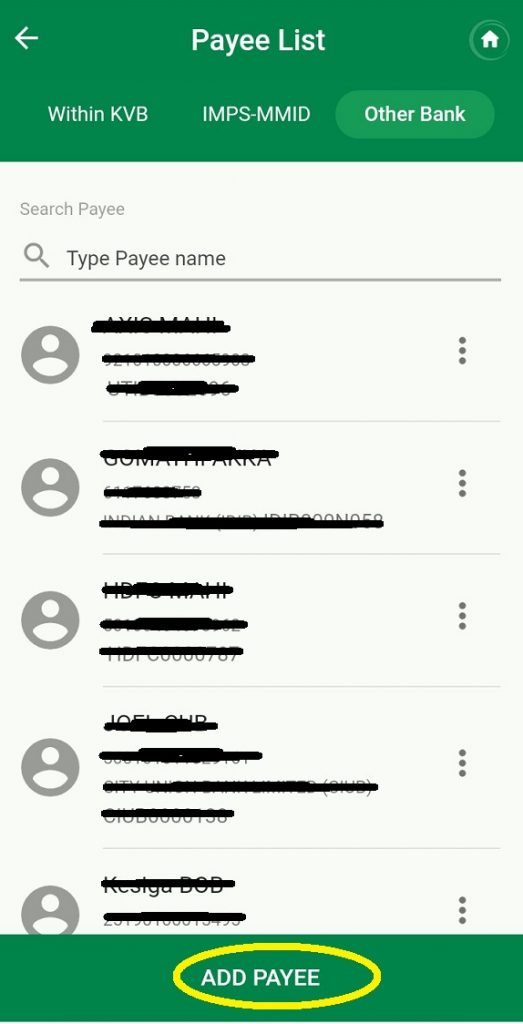

Here, you will see ‘Within KVB’ option for adding KVB accounts and ‘Other Bank’ option for adding other banks account.

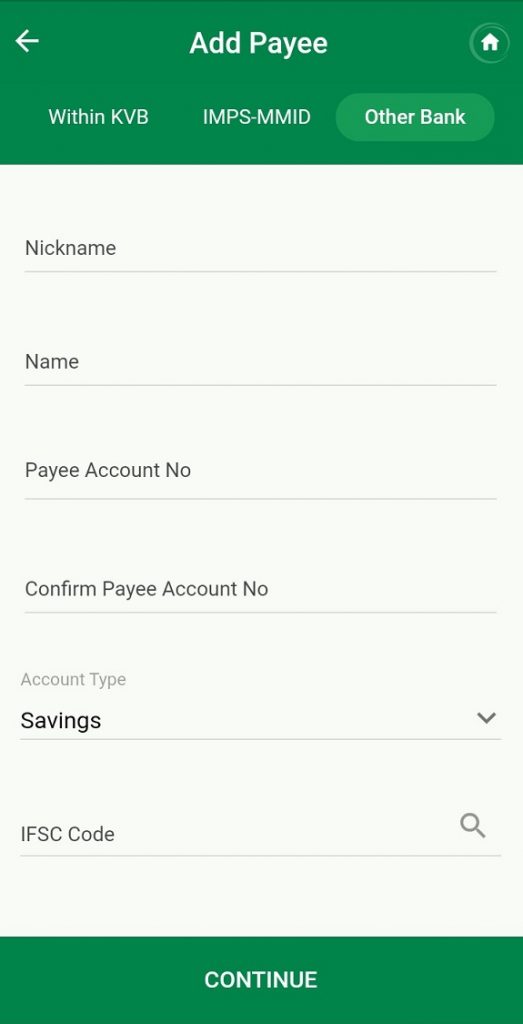

- Now select the appropriate option and click on “Add Payee” button. Then in the next screen, fill the details of Beneficiary

- Nick Name – you can give any nick name for this account

- Beneficiary account name – fill their name as exactly in the bank account

- Account Number – enter full account number

- Confirm Account Number – again enter the full account number for confirmation

- Select the account type – whether Savings or Current etc.,

- IFSC code – enter the beneficiary IFSC code correctly. You can also use search option for selecting correct IFSC code.

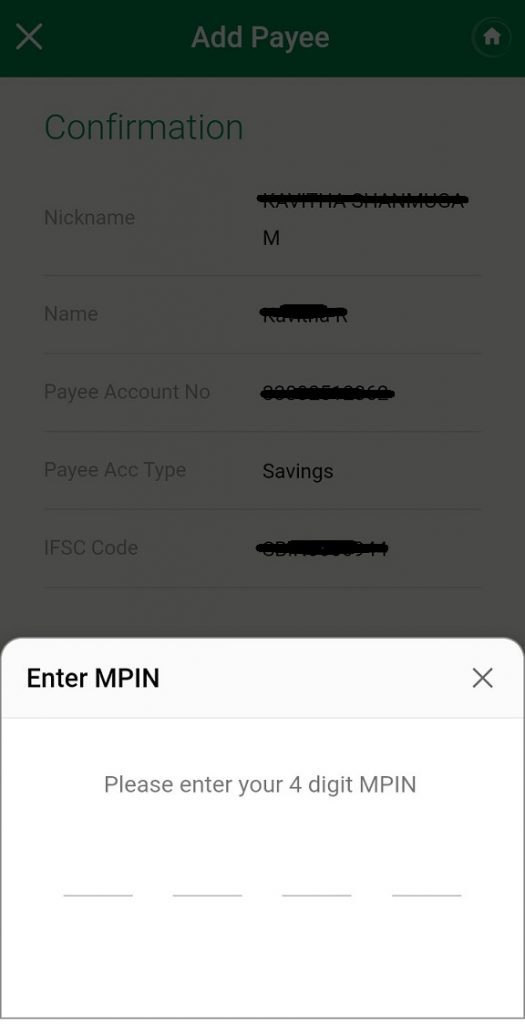

- After entering account details correctly, click on ‘CONTINUE‘ button. Now you can verify the details again and then click on ‘Confirm‘ button.

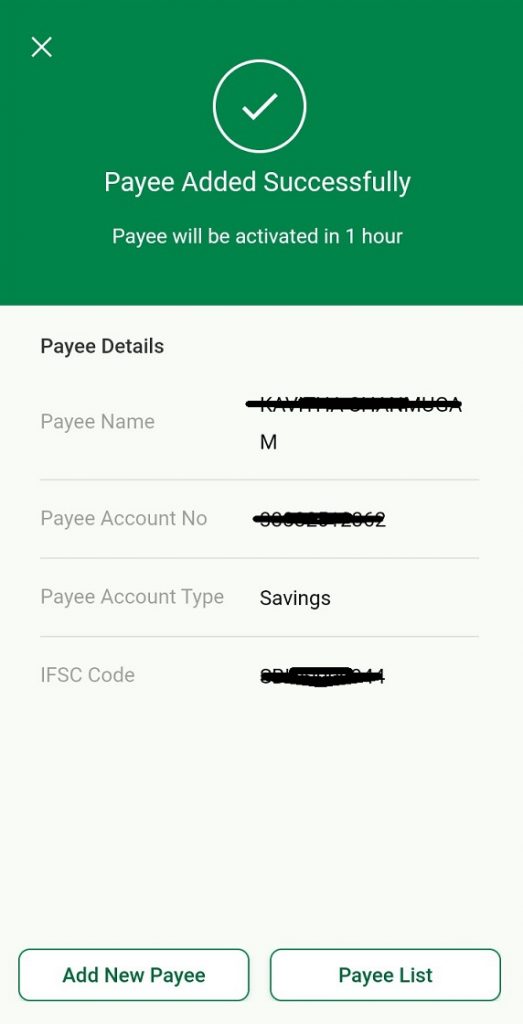

- Then, it will ask for your 4-digit Mpin. Enter your Mpin correctly. Now your beneficiary account has been added in Dlite application and you can see “Payee Added Successfully” in the next screen as shown in the image.

Once you added Payee / Beneficiary, it will take 1 hour to activate that account. After that you can use this account for fund transfer purpose.

How to delete the beneficiary account in KVB Dlite app?

Once you added the beneficiary account, it will be available in your “Payee List” for future use. If you wrongly added the account number, ifsc code or account name, you cant to modify it. Instead, you have to delete the Payee name and freshly add the details correctly. Follow the below simple steps for deleting the beneficiary / payee account in KVB Dlite application.

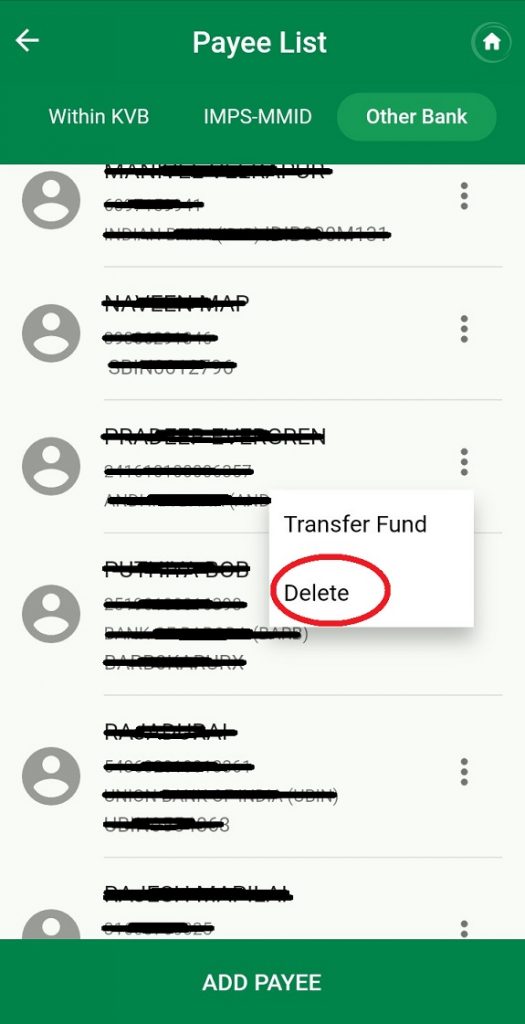

- Firstly, login to your Dlite application and go to “View Payee list” as stated above. In this screen, you will see all the payee list which you were already added in the application.

- Click on the Three DOT option near to the payee account. Then you will the ‘delete‘ option as shown in the image.

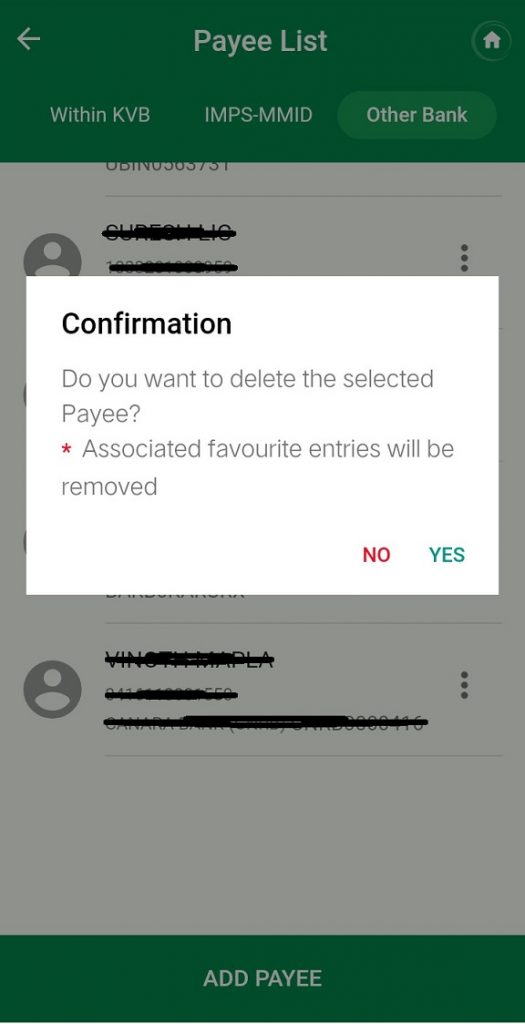

- Click on the ‘Delete‘ option then it will ask for confirmation for deleting the payee account.

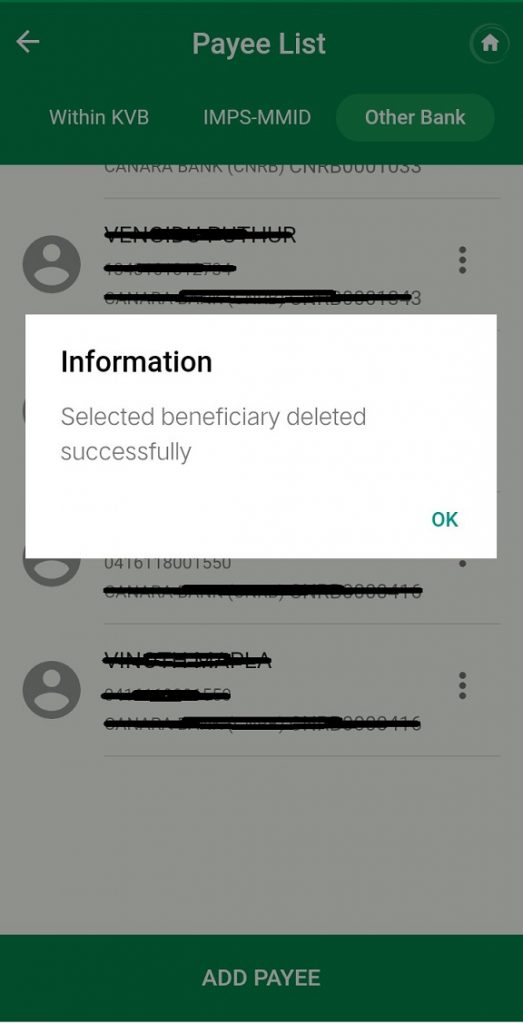

- Now, click Yes option then your payee account will be permanently deleted from the Dlite application.

Many of the banks have been merged with other banks and New IFSC code has been assigned for merged bank branches. You may want to change the IFSC code of those bank’s account in your Dlite application. Follow the above simple steps to delete that particular account and add again with new IFSC code. So that your fund will be transferred to the correct beneficiary account.

Do you want to know your NEW IFSC CODE? Click Here!!