Karur Vysya Bank always delight the customer by way of its customer service. To prove that, KVB named its Mobile banking application as “KVB D-LITE”. Customer can do all their banking transactions, for both Financial and Non financial, using KVB D-Lite Mobile banking application.

Customer can create / activate KVB mobile banking facility using their ATM Card

- Firstly, Customer has to download KVB D-Lite mobile application in Google Play Store / iOS.

- Secondly, click Register for Mobile Banking

- Enter Nickname, Customer id and Registered Mobile number

- Then you will get an OTP. Enter OTP for validation.

- After successful validation, you will have two option for authentication -> Debit card / Internet Banking.

- After successful authentication set your 6 digit Login pin and 4 digit mPin.

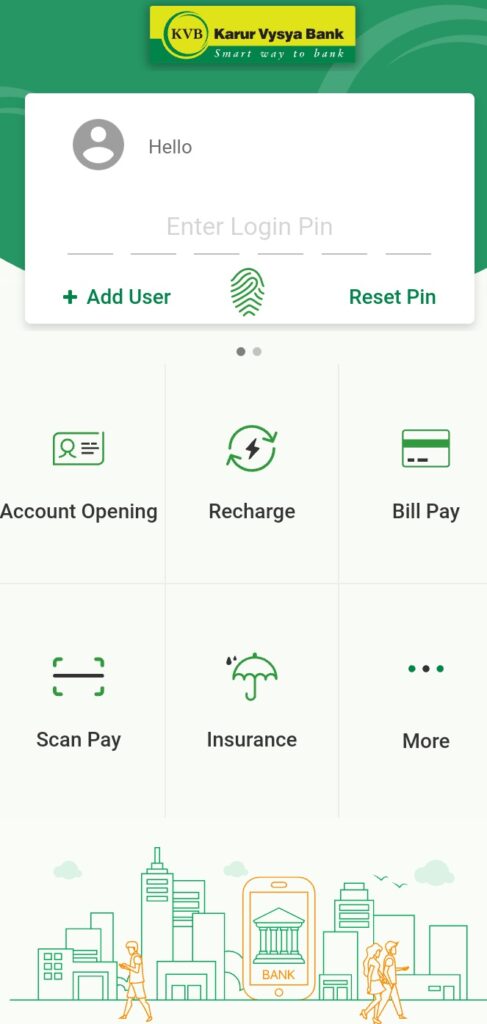

Services available in KVB D-Lite Mobile banking

- Online Gold Loan – Customer can open and close Jewel loan

- Fixed Deposits, Recurring Deposits – Open and Close option

- Fund Transfer through NEFT, RTGS and IMPS

- Unified Payment Interface (UPI)

- FASTag, E-ASBA, Bharat QR

- TNEB Payments, Recharges (DTH & Mobile)

- Cheque Services, ATM Card Control

- Alert Maintenance, E-Statement Maintenance

- Debit Card Hotlist

- Demat Services

- Insurance Management

- Profile Updation -> change of Mobile Number, PAN and Aadhar Updation

Features D-Lite

- All-in-one App for both financial and non-financial operations

- Instant PIN Reset and Unlock through OTP

- Supports both Android and iOS

- Scan & Pay option on board.

- Quick Funds Transfer without Beneficiary addition up to Rs. 50,000/-.

- Multi User Login (max 10)

- Apply and Recharge FASTag easily

- Unlock the app using Fingerprint

For more details visit www.kvb.co.in

[…] Karur Vysya Bank, a leading private sector bank, always delight the customers by way of its customer service. To prove that, KVB named its mobile banking application as “KVB DLITE”. Customer can do all their banking transactions, both Financial and Non-financial, using KVB Mobile banking application. D-Lite application is available in both Android and IOs platform for user download. Do you want to know how to activate KVB DLITE mobile application? Click Here! […]

[…] our previous articles we have explained about How to activate KVB Dlite Mobile Banking? and How to reset Login Pin and Mpin for KVB Dlite application?. Now this article will explain you […]