In olden days, it was the practice of walking to the bank branch for transacting the fund transfer from one bank to another bank. In those days, the banker in branch will inform the IFSC code where we wanted to transfer the fund. But, in the present technology world, it is not necessary to walk to bank branch instead of that we can do all the banking transactions using our Smart phone itself. One of such transaction is Fund Transfer from one bank to another bank.

The banks are providing Mobile banking facility and Internet banking facility to customer for facilitating all the banking transactions using mobile phone and computers without walking to the branch. All we need to know is, we have to understand how to do a safe and secure transaction and what are the important information we must know before executing a transaction. One of such information is IFSC code.

What is IFSC code?

IFSC stands for Indian Financial System Code. It is an Eleven (11) digit code which is a combination of alphabets and numerical. IFSC code is a UNIQUE code assigned by RBI for each branch of a particular bank. It is mainly used to facilitate Electronic Fund transfer in the country.

What is the format of IFSC code?

Format of the eleven digit is

- First four digits will be Alphabets which represents bank name

- Fifth digit will always be ZERO (0)

- The last six digits can be either numerical or alphabets

For Instance, Let us take example of SBIN0000827.

- Here the first four letters – SBIN – represents the bank “State Bank of India”

- The fifth letter is obviously Zero

- The last six letters represents branch name – Coimbatore branch of SBI bank.

What are the uses of IFSC code?

The main use of IFSC code is to facilitate electronic funds transfer in the Country. This code solely represents the particular branch of a bank which participates in three main payment and settlement systems such as National Electronic Fund Transfer (NEFT), Real Time Gross Settlement (RTGS) and Immediate Payment Services (IMPS).

Without the IFSC code funds can not be transferred from one bank to another bank through electronic fund transfer. It helps to carry beneficiary information of a fund transfer to the beneficiary bank.

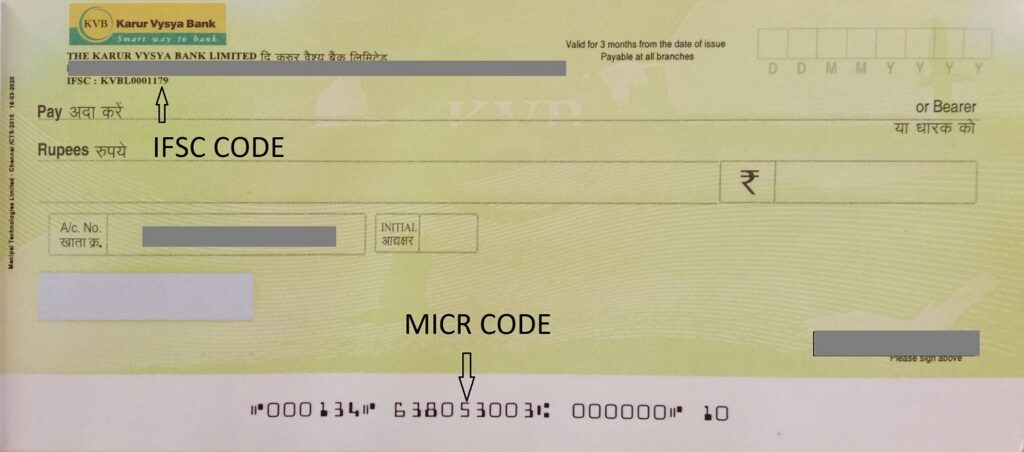

IFSC code usually printed on the top left corner of cheque leaf, under the bank name and address details printed on the cheque. Customer can also find it printed on the first page of bank’s savings account passbook.

What is MICR code?

MICR stands for Magnetic Ink Character Recognition technology. It is a Nine(9) digit numeric unique code that identifies the bank and branch which participating the Electronic clearing System (ECS). MICR code usually printed on the Cheque of a particular branch of a bank.

What is the format of MICR code?

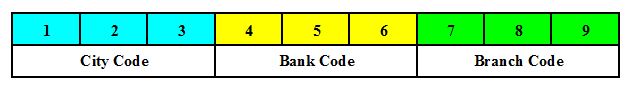

Format of Nine digit MICR code is

- First three digits represent CITY where the branch is located

- Second three digits represent particular bank

- Last three digits represent particular branch of the bank

The MICR code usually printed on the bottom of a cheque leaf, next to the cheque number. Customer can also find it printed on the first page of bank’s savings account passbook.

General points to note about IFSC and MICR

Both IFSC and MICR are unique codes assigned for the particular branch of a bank. They are common for all the customer who are having account with the particular branch. It is customer responsibility to know the IFSC and MICR codes after opening a account with the particular branch. They can find these codes printed on the first page of Savings account pass book given by the bank.

You have to ensure the correct IFSC number while specifying it for NEFT, RTGS and IMPS fund transfers. If you wrongly mentioned the code the funds will be transferred wrongly.