IMPS – Immediate Payment Services. In today’s scenario everybody wants to do everything in a faster manner. More pacifically, everybody wants to do banking transaction in such a way that it should complete within a fraction of seconds. In order to enable them to complete the fund transfer faster the Reserve Bank of India introduced IMPS mechanism. It was introduced in the year 2010 and National Payments Corporation of India (NPCI) is responsible for managing the IMPS fund transfer mechanism in India.

The other funds transfer mechanisms such as NEFT (National Electronic Fund Transfer) and RTGS (Real-time Gross settlement) are only available during their business hours. Moreover, NEFT and RTGS were not available on bank holidays. So it has been introduced to cater the funds transfer for all the time i.e, 24 x 7 x 365.

Presently, all bank branches in India are enabled to provide this service to their customers. Regional Rural Bank (RRBs) are also providing this service to the customer through their sponsor bank.

Table of Contents

What is IMPS?

IMPS stands for Immediate Payment Services. It is one of the electronic fund transfer system that facilitates the funds transfer from one bank to another bank. More particularly, IMPS meant for instant funds transfer. It settles the amount to beneficiary account as soon as the funds released from the sending account. The major feature of IMPS is that it is available at all times for public usage from the day it was introduced.

How to transfer funds using IMPS?

Funds transfer can be done using two different elements

- Using Account details such as IFSC Code, Account Number and MPIN – For Person to Account transfer

- Using Mobile Number and Mobile Money Identifier (MMID) – For Person to Person transfer.

Steps for funds transfer using IMPS: (Person to Account)

You can use your Internet/Mobile banking facility offered by your bank for funds transfer through IMPS. You have to clearly provide details of beneficiary such as,

- Name of the beneficiary

- IFSC of the beneficiary bank branch

- Account Number as mentioned in the Passbook given by bank

- Account type whether Savings account or Current account or Cash Credit, etc.

Steps:

- Firstly, Login to mobile banking or net banking

- Select fund transfer and go to funds transfer to other bank

- Enter beneficiary details such as Name, Account Number, Amount, IFSC, Remarks and click submit

- Then Double check the correctness of entered values and click submit

- Now give MPIN (in case of mobile banking) or TPIN (in case of net banking) for completing the transaction.

- Funds will be transferred instantly and SMS confirmation will be sent to both the sender and receiver.

Steps for funds transfer using IMPS: (Person to Person)

Generally, if you want to use Person to Person option for funds transfer, you should have the beneficiary’s Mobile Money Identifier (MMID) and your MPIN (Mobile PIN) for completing the transaction.

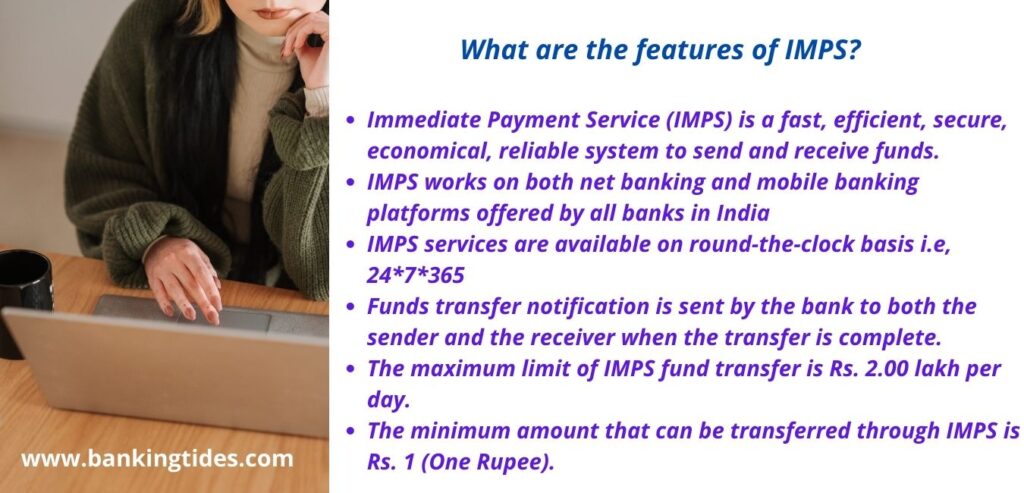

What are the features of IMPS?

The following are some of the features of Immediate Payment Services

- Immediate Payment Service is a fast, efficient, secure, economical, reliable system to send and receive funds.

- It works on both net banking and mobile banking platforms offered by all banks in India

- It is available on round-the-clock basis i.e, 24*7*365 even on public and bank holidays.

- Particularly, Amount can be transferred to any beneficiary through IMPS mobile platform by only providing his/her Mobile Number and Mobile Money Identifier (MMID).

- Further, Bank account numbers are not necessarily required for IMPS fund transfer if you are transacting through mobile (for Person to Person transfer).

- Funds transfer notification is sent by the bank to both the sender and the receiver when the transfer is complete.

- The maximum limit of fund transfer is Rs. 2.00 lakh per day.

- The minimum amount that can be transferred through IMPS is Rs. 1 (One Rupee).

As per RBI Notification dated 08.10.2021

RBI increased the IMPS per-transaction limit from ₹2 lakh to ₹5 lakh.

What are the charges for IMPS transactions?

Generally, IMPS charges are subject to bank’s internal policy. However, regular charges are ranging from minimum of Rs.2.50 to maximum of Rs.25.00 which depends on the amount of transfer. Some of the illustrated charges are

| Transfer Amount | Charges (Subject to Change According to Banks) |

| Up to Rs. 1,000/- | No charges |

| From Rs. 1,001 to Rs. 1 lakh | Rs. 5 + Applicable GST |

| From Rs. 1 lakh to Rs. 2 lakh | Rs. 15 + Applicable GST |

What are the other platforms for funds transfer other than IMPS?

Other platforms available for funds transfer other than IMPS are National Electronic Fund Transfer (NEFT) and Real Time Gross Settlement (RTGS).

RTGS stands for Real Time Gross Settlement. Initially, It was introduced in the year 2004. It is also one of the Electronic fund transfer system, which facilitates a continuous and real-time settlement of fund transfers, individually on a transaction by transaction basis.

NEFT stand for National Electronic Fund Transfer. It is also one of the Electronic fund transfer system that facilitates an efficient, secure, economical, reliable system of funds transfer in the banking sector through out India. Further, NEFT is exclusively owned and operated by the Reserve Bank of India. It transfers the funds from one bank account to another bank account.

Nice and easy to read and understand.

thank you for your information.