Permanent Account Number (PAN) is a unique 10-digit alphanumeric number issued by Income Tax Department, India. It is assigned for Individuals, HUF and all type of entities (like Partnership company, Limited company, Trust, etc.,). PAN is primarily meant for linking and retrieving all type of financial transactions of a card holder. It is one of the most important documents in filing income tax return. It also plays a vital role in officially valid KYC document for opening a bank account.

PAN Card is a physical card that has your PAN number as well as your Name, Father Name, Date of Birth (DoB), Photograph and your signature. It can also be submitted as a proof of Identity and Date of Birth (DoB).

Table of Contents

What is e-PAN?

The Income Tax Department of India recently introduced ePAN card with an intent to allot instant Permanent Account Number card to the first-time taxpayers. You can get this ePAN only through online mode in PDF file format and also it is free of cost. It is a digitally signed PAN card that is issued based on Aadhar e-KYC details. It holds same value as physical PAN card.

Who can apply for an e-PAN?

Any Resident Indian Individual have to satisfy the following condition to get your instant ePAN

- Any Individual (not an Entity) taxpayer can apply for ePAN

- You should not hold a PAN already

- You must have an Aadhar Card

- Your mobile number must be linked with your Aadhar Card

- Your complete date of birth must be available in Aadhar Card

- You should not be minor on the date of application for ePAN

- Your Aadhar must have correct and updated details

How to apply for new Pan online in new e-Filing 2.0 website?

You know that, recently The Income Tax Department launched the new e-filing website for Income Tax Returns. The URL of new income tax e-filing portal is https://www.incometax.gov.in. Many new features such as Aadhar Pan linking, e-verify, e-pay tax, verify TAN, Pan Aadhar linking status, ect,. are available in new website. Accordingly, you can also apply for new e-PAN in new e-filing 2.0 portal.

Go to new website of income tax

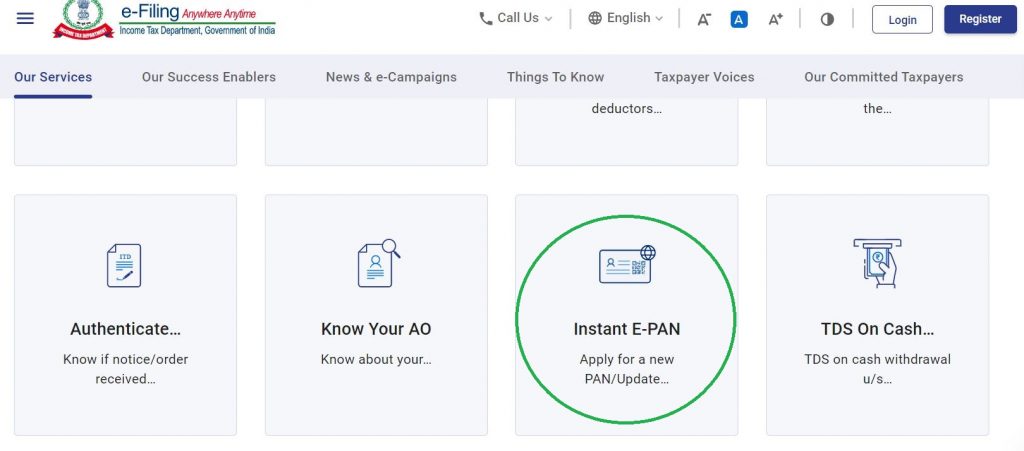

Firstly, visit e-filing official website https://www.incometax.gov.in and then Click on the “Instant E-PAN” menu in the Our Services section.

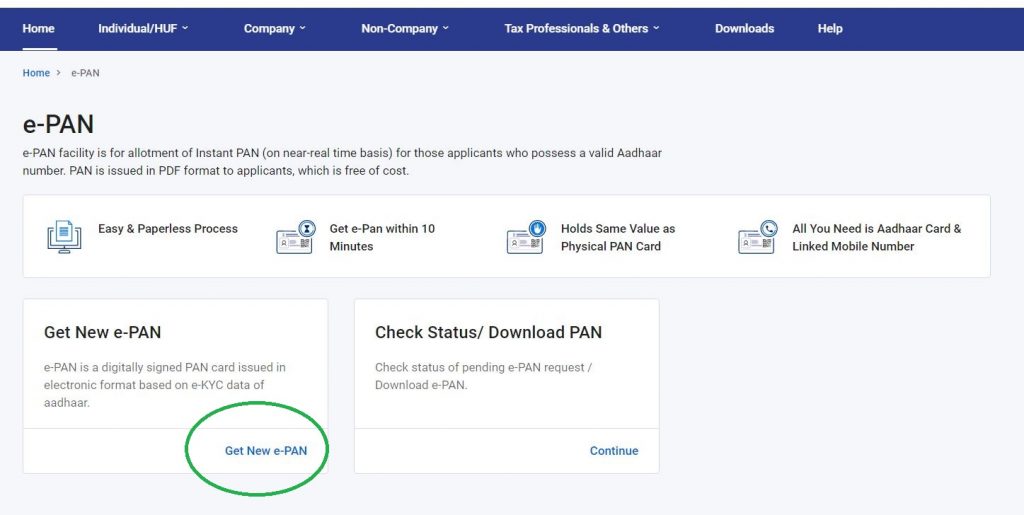

In the next page, click on ‘Get New e-PAN‘ option as shown in the image below

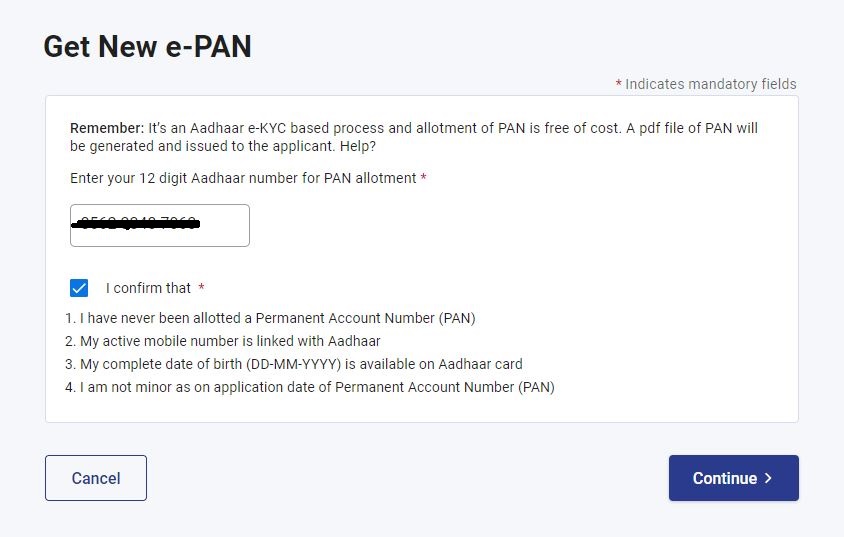

In the next screen, Enter your 12 digit Aadhar number in the respective field and check the ‘I Confirm that’ check box to confirm the conditions and then click on ‘Continue‘ button. Refer image below.

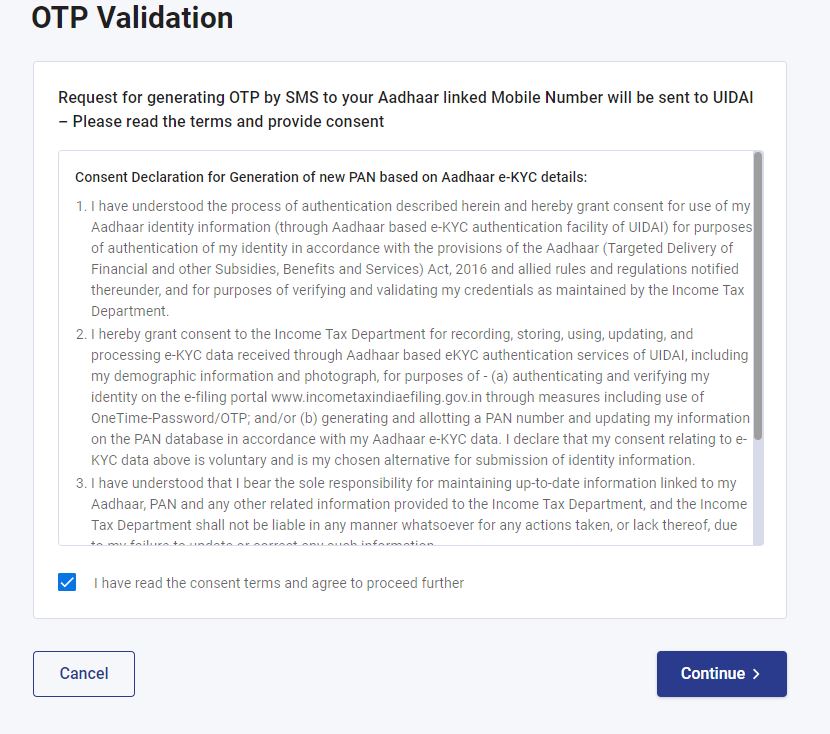

Now, you have to give your consent declaration for generation of new Permanent Account Number based on Aadhar e-KYC details. Read all the particulars carefully and check the box ‘I have read the consent terms and agree to proceed further’ and then click on ‘Continue‘ button.

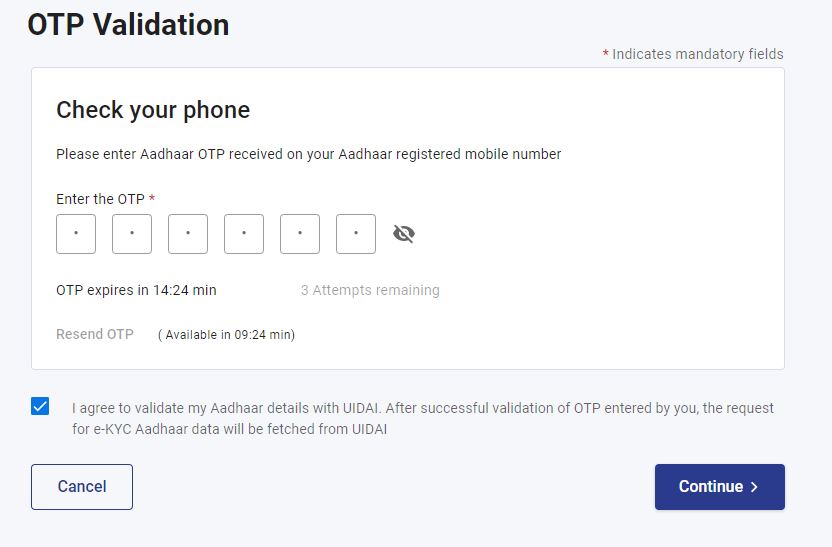

OTP Validation

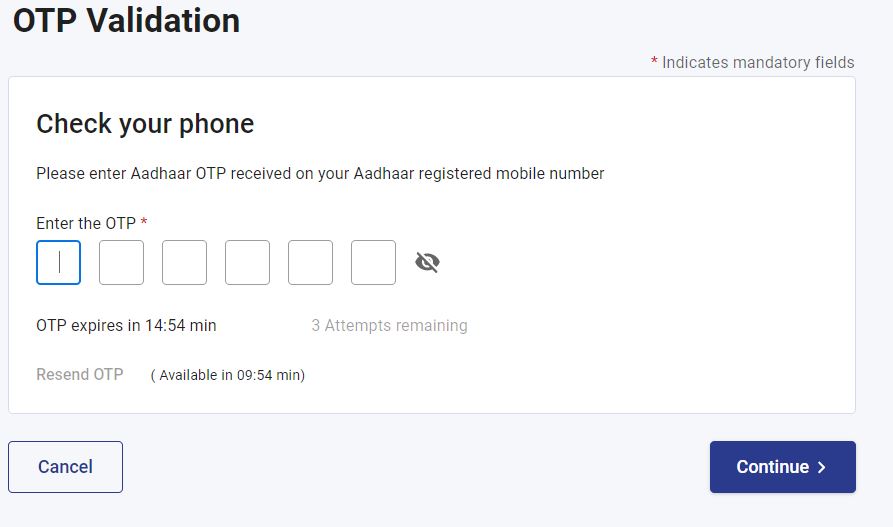

Now, you will receive an OTP to your Aadhar linked mobile number. Enter the OTP in the respective field and check the box ‘I agree to validate my Aadhar details with UIDAI’ and then click on ‘Continue‘ button.

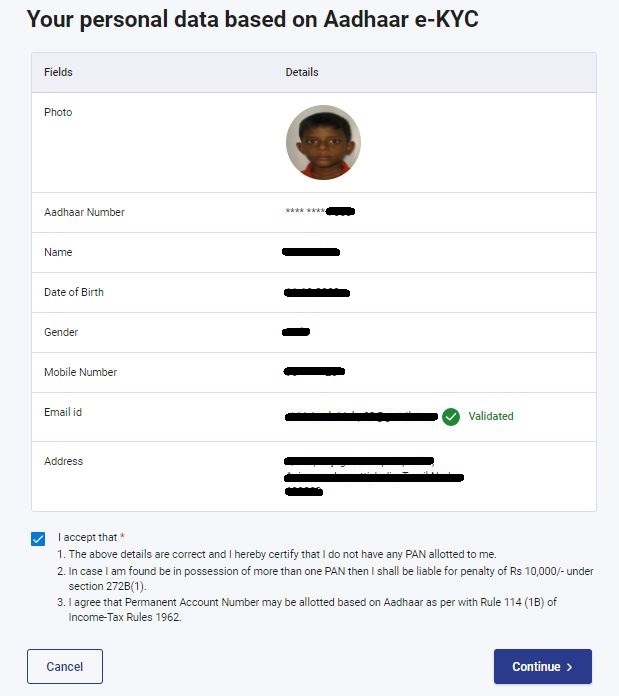

Check your Aadhar details

- Now you will see your personal details as per your Aadhar. Verify your Name, Date of Birth, Gender, Mobile Number, Email ID and address details.

- If email id is not available in Aadhar details, you can add your email id instantly here. Enter your valid email id in the respective field then you will receive an OTP to your email id. Enter the OTP for successful validation.

- Now, check the ‘I accept that‘ check box for the conditions listed as per the image and then click on ‘Continue‘ button.

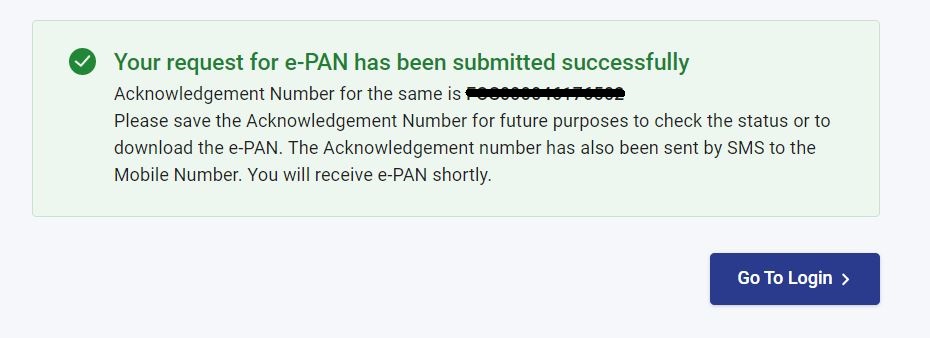

Then you will see the message ‘Your request for e-PAN has been submitted successfully‘. Also you will gen an acknowledgement number. Use this acknowledgement number to check the status and to download the e-PAN latter.

How to download your e-PAN?

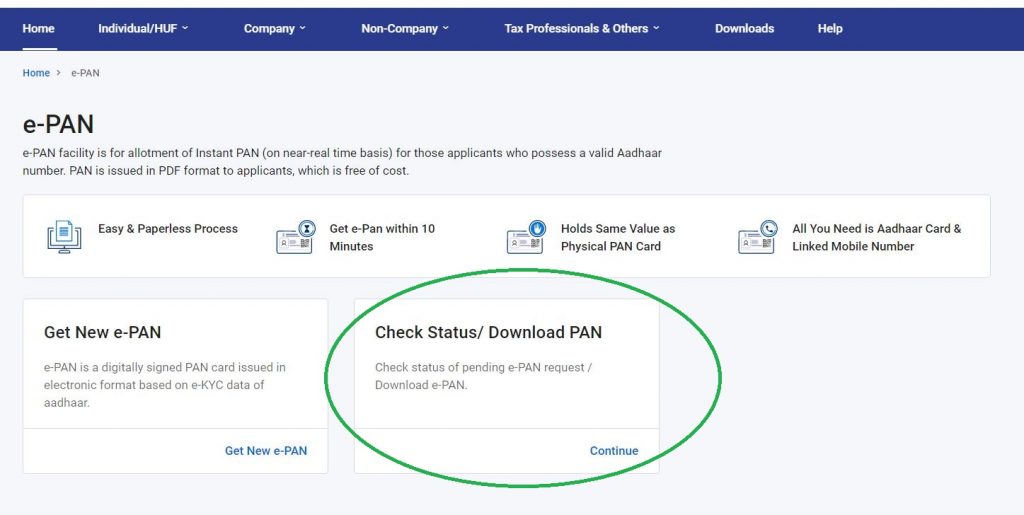

- Firstly, visit e-filing official website https://www.incometax.gov.in and then Click on the “Instant E-PAN” menu in the Our Services section.

- In the next page, click on ‘Check Status / Download PAN‘ option as shown in the image below

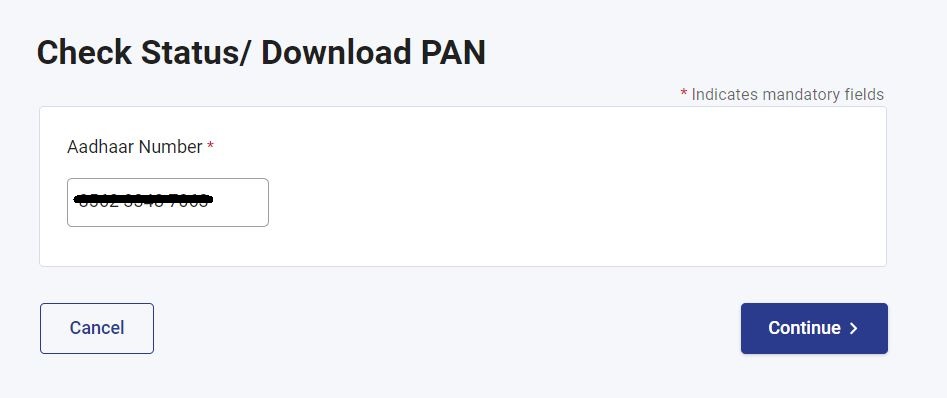

- In the next screen, enter your 12 digit Aadhar number and click on ‘Continue‘ button.

- Now you will receive an OTP to your Aadhar linked mobile number.

- Enter the OTP in respective field and click on ‘Continue‘ button

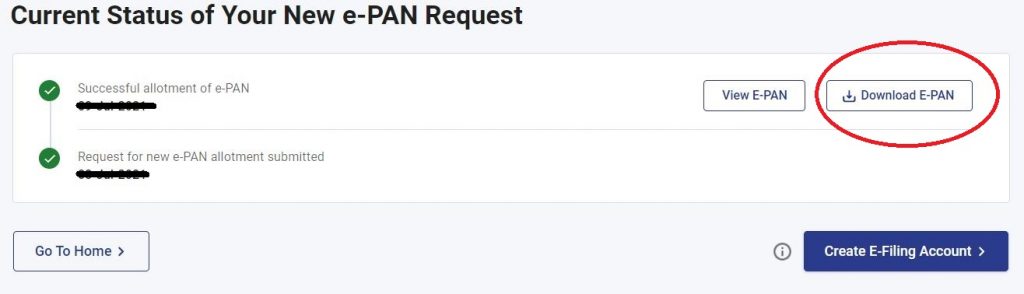

In the next screen, you will see the current status of your new Permanent Account Number request. You can download your E-PAN on the successful allotment of Permanent Account Number as per the image below.

Note:

E-PAN in pdf file holds the same value as Physical Card.

Frequently Asked Questions

Whether E-PAN hold same value as physical PAN?

Yes, there is no difference between them. Your E-PAN in pdf file holds same value as physical PAN.

Whether an Individual hold more than one PAN?

No, a person can not hold more than one PAN. If found, a penalty of Rs. 10,000/- is liable to be imposed under section 272B of the Income-tax Act, 1961 for having more than one PAN.

What should I do, if I have more than one PAN?

If a person has been allotted more than one PAN, then he/she should surrender the additional PAN card immediately.

What should I do, if I don’t have mobile number, complete DOB in my Aadhar?

First you should link your mobile number and date of birth in Aadhar in UIDAI portal. Then you can apply for e-PAN card.

Do I have to pay any fee for e-PAN?

You don’t have to pay any cost for e-PAN. Since it is downloadable in PDF file format, it is free of cost.

Will I get a physical PAN card for e-PAN?

No, you will be issued an e-PAN in PDF format only which is a valid form of physical PAN.

Hi, whether all the Banks and Financial Institutions accept this online pan as a valid proof?? Because we hold only soft copy of PAN..

Your E-PAN in pdf file holds same value as physical PAN.