Axis Bank Positive Pay System – We all know that Reserve Bank of India (RBI) introduced Positive Pay System for strengthening high value cheque clearing in CTS (Cheque Truncation System). Accordingly all the customers have to register their high value cheques in their respective bank’s PPS before submitting to CTS for clearing.

Table of Contents

Why Positive Pay System is introduced?

Positive Pay System (PPS) enables an additional security layer to the cheque clearing process. The cheque issuer have to submit cheque details such as Cheque date, Beneficiary Name, Amount and Cheque number in PPS. When the beneficiary submits the cheque for clearing, the presented cheque details will be compared with the details provided to the bank through PPS. If any mismatch found between the PPS and presented cheque, the CTS will reject the cheque.

How to register a cheque in Axis Bank Positive Pay System?

Axis Bank recently announced that sharing the cheque details through PPS for cheques amounting to Rs. 5.00 lakhs and above has been made mandatory with effective 1st September, 2021. In case of non-submission of PPS details by the customers, cheques with value amounting to Rs. 5.00 lakhs and above will be returned to the presenting bank with return reason description “Positive Pay details not available”, once the cheque is presented through CTS clearing.

Channels available to share the Positive Pay details are:

- Branch Channel: You can walk to the bank branch and fill in a simple form and submit the details over the counter.

- Digital Channel: You can also log in through following digital channels

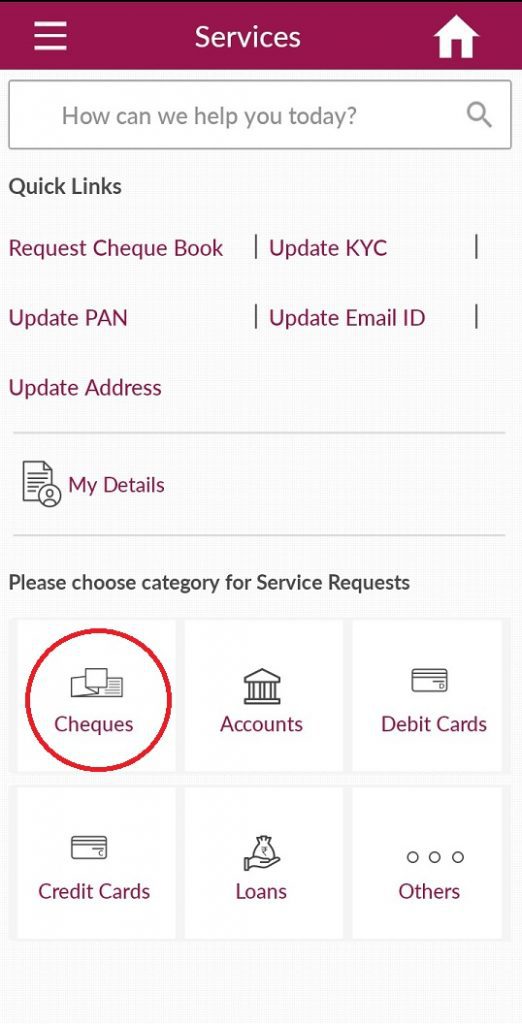

- Retail Mobile Banking: Select Services option >>Cheques>>Positive Pay

- Retail Internet Banking: Select Services option >>Positive Pay

- Corporate Mobile Banking: Select Service Request >>Positive Pay

- Corporate Internet Banking: Select Service Request >>Positive Pay

Steps for sharing a Cheque in Axis Bank PPS through Mobile Banking

The following are the simple steps for sharing the cheque details in Axis Positive Pay System through Mobile banking:

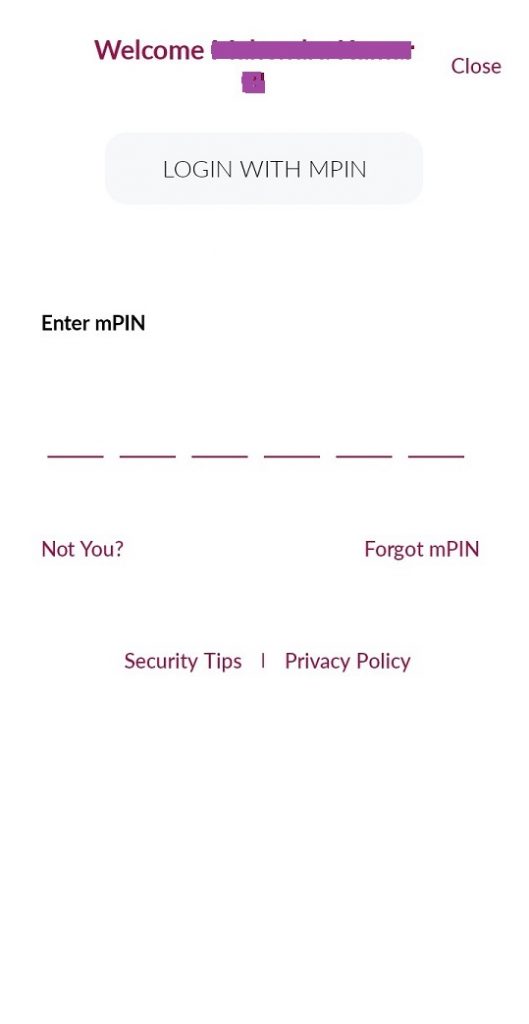

- Firstly login to Axis bank mobile banking application using your log in password.

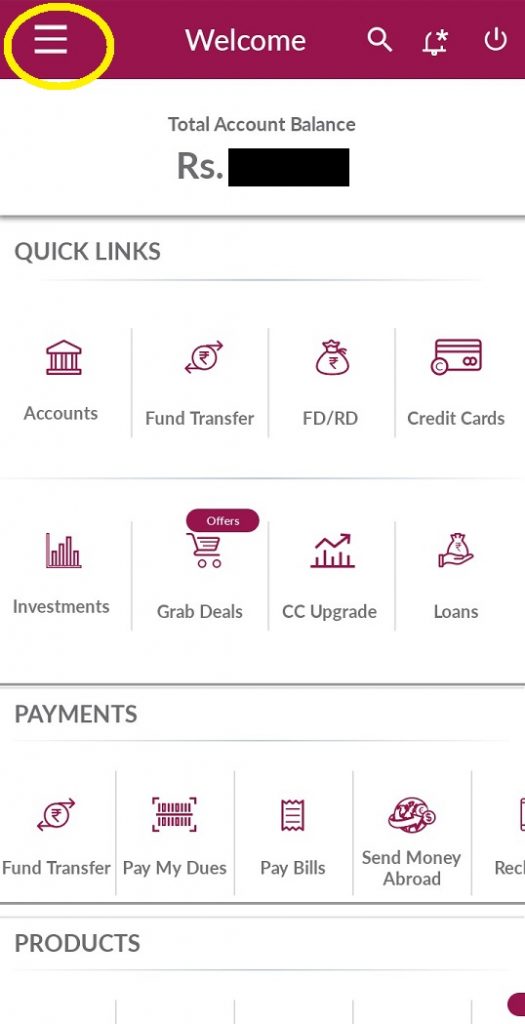

- Then click on the Menu option available in the top left corner as shown in the image below.

- Then it will display the Menus’ available in the Axis mobile banking.

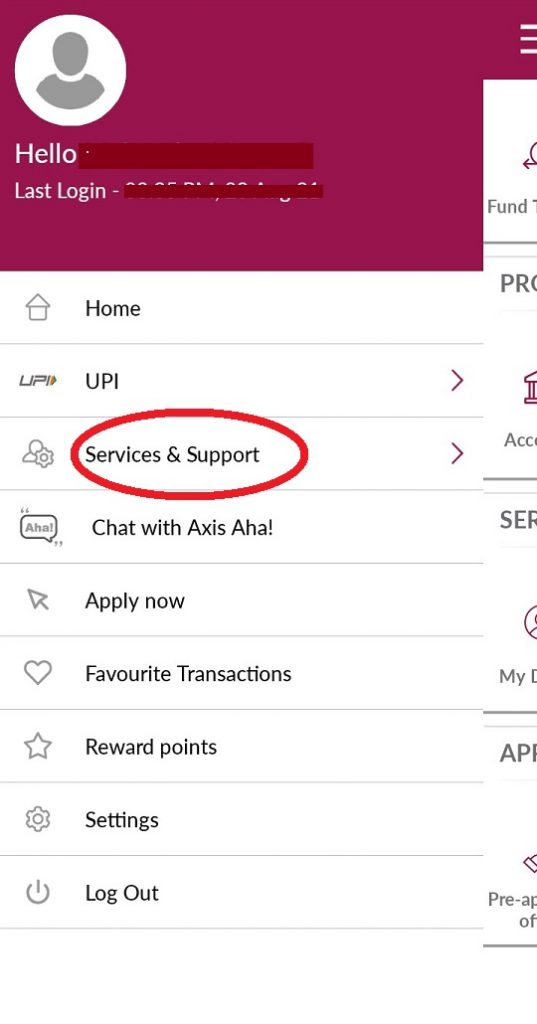

- Click on the ‘Services & Support‘ option then you will get all services available.

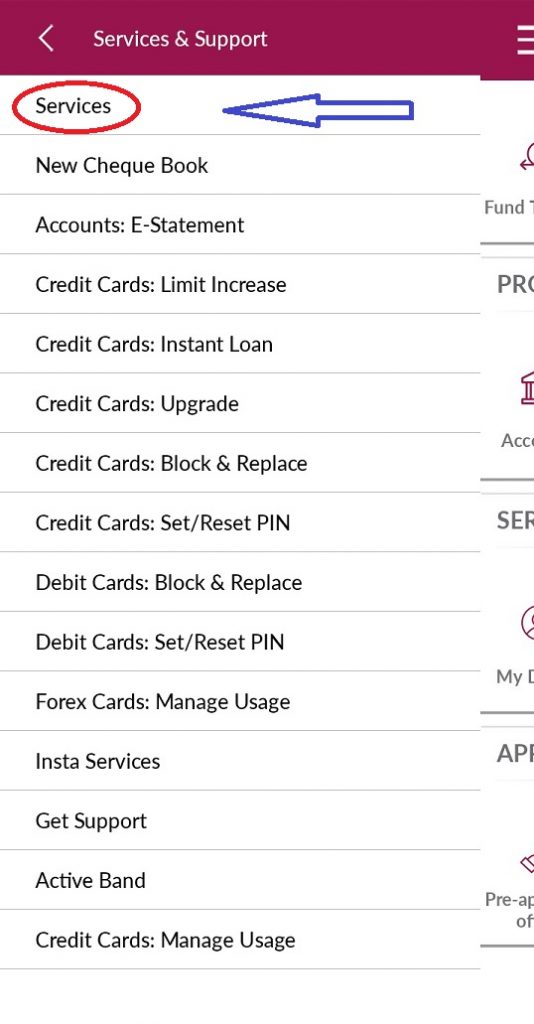

- Click on the ‘Services’ option as shown in the image.

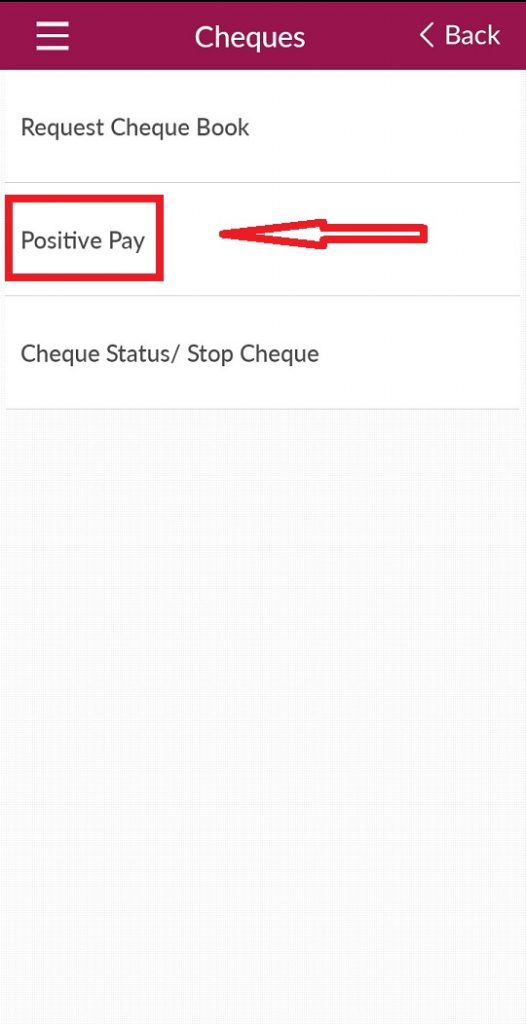

- In the next step, click on the ‘Cheques‘ option then it will display the menus Request Cheque Book, Positive Pay and Cheque Status / Stop Cheque.

- Now click on the ‘Positive Pay‘ option then it will ask you enter your cheque details

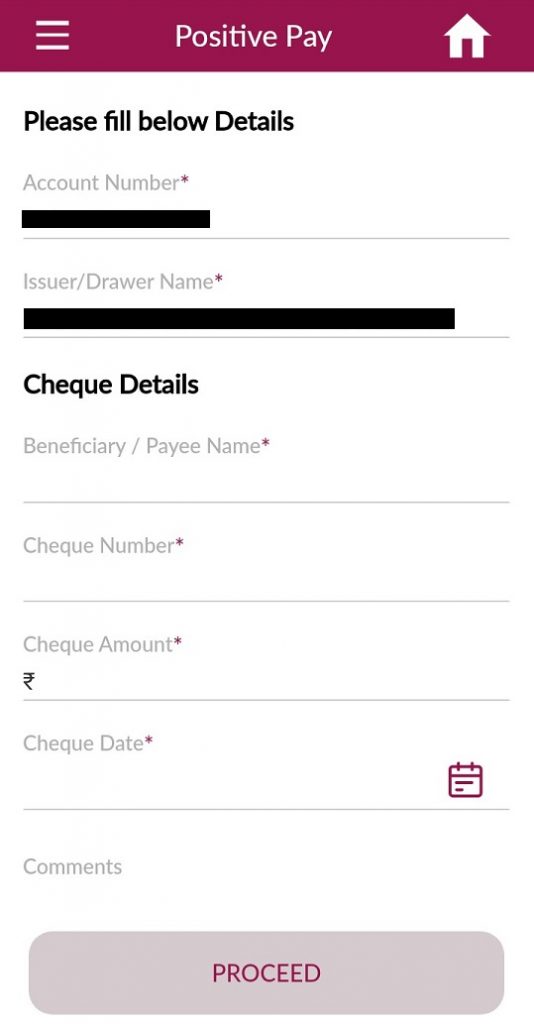

- Enter the details such as Payee Name, Cheque Amount, Cheque Number, Cheque Date and Comments in the respective field and click on ‘Proceed‘ button.

- Then it will ask you enter your mPin for completing the transaction. Enter your mPin the respective field correctly. Now you have successfully shared your cheque details in Axis Positive Pay System.

Note:

Axis Bank advise the customers to share cheque details in PPS at-least one working day prior to cheque presentation date.

Only cheques that are compliant with the PPS will be accepted under RBI dispute resolution mechanism